- Successful Forex Trading Strategies Latest News

- What is the secret to successful forex trading?

- Stage 1 Model: High-Quality Forex Trading Course

- Stage 2 Model: Develop Trading Portfolio – Use Successful Forex Trading Signals

- Stage 3 Model (A): Create Your Own Autopilot Trading with No Programming

- Stage 3 (B) Model: Use Successful Forex Trading Robot

- Stage 4 Model: Successful Forex Trading – Earn Commission

- Conclusions

Successful Forex Trading Strategies Latest News

We regularly update the useful tips for successful forex trading, successful forex trading strategies or successful forex trading stories in this section.

Meditation To Calm Your Nervous System

Yvan Byeajee, an expert of trading psychology from Trading Composure (see details later) set the video of “Prepare Yourself For The Trading Day”, watch;

This meditation will help calm your nervous system. Feel free to use it whenever there’s a need for it before, during, or after the trading day.

You may want to consider Trading Psychology Mastery course Claim $50 Discount NOW

Meditation For Traders | Will Prepare You For The Trading Day

Yvan Byeajee, an expert of trading psychology from Trading Composure (see details in the next section) set the video of “Prepare Yourself For The Trading Day”, watch;

This 20-minute guided meditation for traders will help put you in the right frame of mind before the trading day begins.

The current situation we live in has given me the opportunity to dive deeper into my practice.

I usually start and end my day with meditation, and it makes a world of difference in the way I think and experiences things.

To help support your own practice, I offer you this 20-minute guided meditation.

It will help prepare you for the trading day.

If you like to sit in silence without any background sounds or music (like I do), here’s a version of that meditation without that.

I hope you find it helpful. Let me know in the comment section if you’d like to see more of this in the future.

Trading ComposureDon’t miss the discount of Trading Psychology course now – Go to this page.

What is the secret to successful forex trading?

Can you be successful in forex trading?

Forex Trading (spot forex market) is a Zero-Sum Game, actually, it’s a negative-sum game by taking brokerage‘ mark-up spread/commission. Therefore, it’s a natural consequence that skilled traders & institutional traders beat the less skilful retail traders.

With that said, our basic strategy for busy people who have not enough time to commit strong efforts to go through proper training & daily analysis is passive trading 3 methods.

Successful forex trading plan

For those who want to do self-trading and want to know how to improve their trading results, allow me to emphasize that Forex trading involves a lot of risks which most definitely outweighs the returns for those who jump the gun and start trading without being fully prepared. At the same time, trading forex can be a rewarding experience for those who are fully prepared.

So, yes, firstly you need a successful forex trading plan with a proper mindset. In our context, the successful forex trading plan means the successful forex trading growth model and successful forex trading systems, namely a quality training course and successful forex trading methods & tools.

Successful growth model – Comprised of 4 Secret model stages

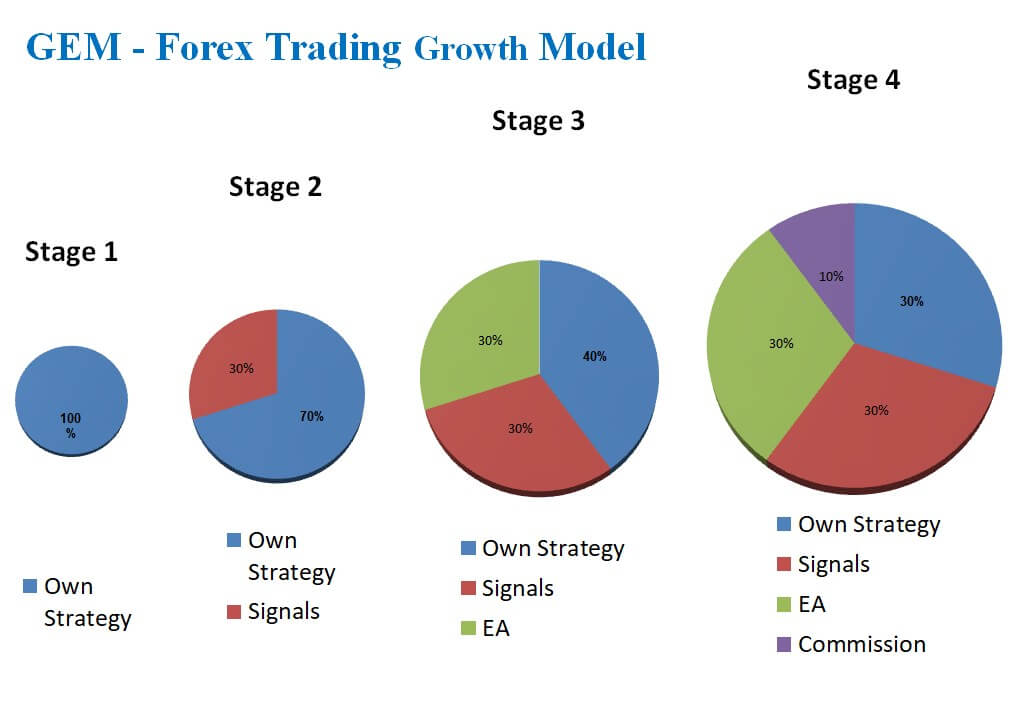

The underlying concept behind the successful forex growth model is a little known progression approach by evolving from Stage 1 model to Stage 4 model – 1st Model: Make Yourself Skilled Trader (Stage 1), 2nd Model: Develop Trading Portfolio (Stage 2 & 3), and 3rd Model: Earn Commission as Extra Profits (Stage 4).

- Stage 1 Model: Go through High-Quality Trading Course to enhance your knowledge & skill. Most importantly train your trading mentality to the professional level, you may need brainwash.

- Stage 2 Model: Develop Trading Portfolio by Diversifying your Trading Method with World Top Level Signal Services, which will help achieve sustainable profitability with better risk control.

- Stage 3 Model: Develop your Own Autopilot Robot (algorithmic trading) without programming and Create EA portfolio on top of your manual trading to enhance risk management.

- Stage 4 Model: Become Master Trader to be copied or followed or invested in Social Trading & PAMM account to make extra income in the form of commissions.

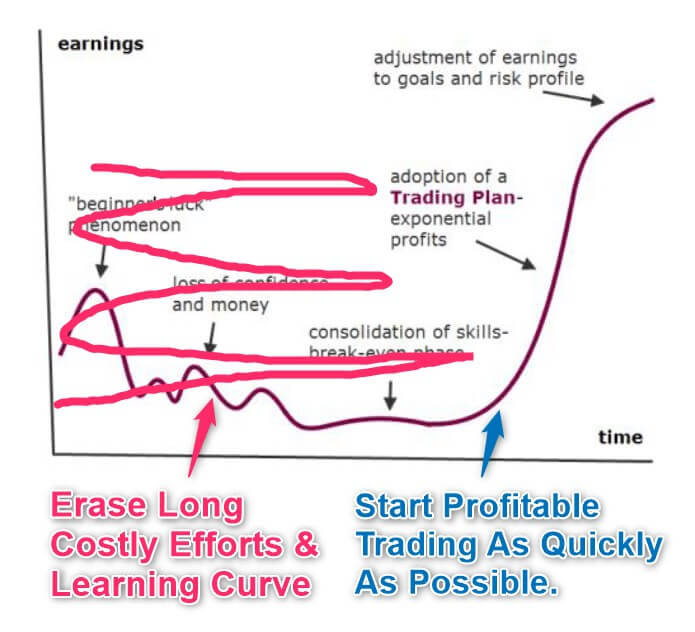

The below shows the image of this growth model. Although the profits from Own Strategy by Manual Trading will grow but its portion will get smaller in % as the other methods’ contribution will be added & bigger;

In order to achieve this growth scenario, we have researched and compiled the world top Best Online Forex Trading systems based on the following criteria;

- Reputation – Feedback from the real users is critical, so gather as many voices as possible to get objective assessment while avoiding the influence by subjective naysayers as much as possible.

- Value For Money – Free is good, and we identified good free tools for very basics but going advanced or specialized method should be a paid one. Thus, the availability of additional benefits such as discount & life-time service etc is explored.

- Easy, Practical & Workable – Keep yourself engaged and see things through to the end is essential for online learners & traders. So, how attractive (interesting & fun) the instructor’s teaching manner & course material and how easy to use the tool & software are carefully considered.

We will explain the keys to successful Forex trading in each stage by introducing the most reliable forex trading systems.

Stage 1 Model: High-Quality Forex Trading Course

If you want to succeed in Forex Trading, firstly you need to foster Top Level Trading Knowledge & Skill through the Absolute Best Course. I can’t stress this enough, Never Underestimate “Quality Training”.

Nearly half of the retail traders and almost every trader who lose money are said to have failed in receiving a well-organized complete training. They tend to gather some basic knowledge online, then register demo trading and jump into the real trading once after seeing a few successful results. Unfortunately, with such shallow skill, nobody can survive more than a few months.

Knowledge is power, and that power will enable you to make logical decisions and continue trading long past the time when a lot of players have gone bust. So, take the below courses which we assure will significantly improve your profitability.

If you already went through enough training courses but still keep losing money, then you may consider looking at the course below or must take the Trading Psychology course because usually, your mentality is the real cause to make wrong decisions.

Basic to Intermediate

2ndSkies Trading by Chris Capre

There are so many online forex trading courses though, 2ndSkies Trading founded by Chris Capre is believed to be one of the most successful forex trading courses. Chris Capre is a professional forex trader and coach specialized in Price Action Trading, Ichimoku & Trading Mindset.

is believed to be one of the most successful forex trading courses. Chris Capre is a professional forex trader and coach specialized in Price Action Trading, Ichimoku & Trading Mindset.

He founded 2ndSkiesForex in 2007 with a mission of “To turn you into a profitable trader by changing the way you think, trade and perform”. Chris has become one of the most admired trading coaches in the world.

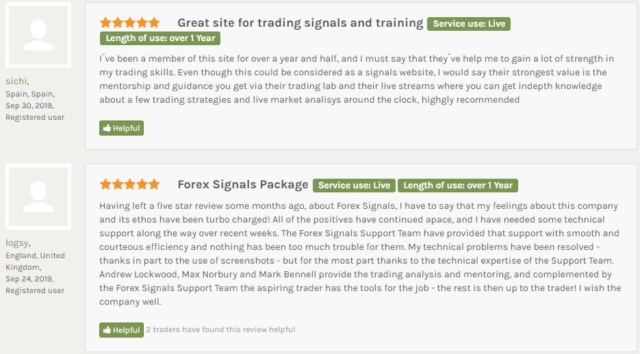

It achieved an impressive 4.79 scores out of 5 scales in FPA (Forex Peace Academy) independent review, you can find a lot of positive comments as below;

Watch the below 2ndSkiesForex introductory video;

If you are relatively new to Forex Trading, don’t pay any money for the basic to intermediary level, you can enjoy free education as;

Check the abundance of Free Valuable Materials like Video Lessons;

If you are a complete newbie, start a Free Beginner course.

If you’re more experienced, or gone through the above beginner’s course, then access to the Free most important/popular articles & videos list, which will give you a unique perspective on trading beyond the typical copy/paste price action or Ichimoku strategies taught out there.

Trading Psychology

Every trader knows that human emotion is the biggest obstacle for successful trading. Therefore, I would personally suggest you should first understand how the trading psychology works & how you overcome the problems before taking the advanced trading course.

2ndSkiesForex – Advanced Traders Mindset

Chris Capre has been studying Neuroscience and Peak Performance for the last 20 years with one focus — to improve ones’ brain, mindset and life. Chris’s Advanced Traders Mindset Course will re-wire your brain by changing the way you think, trade and perform for success in trading.

Trading Composure

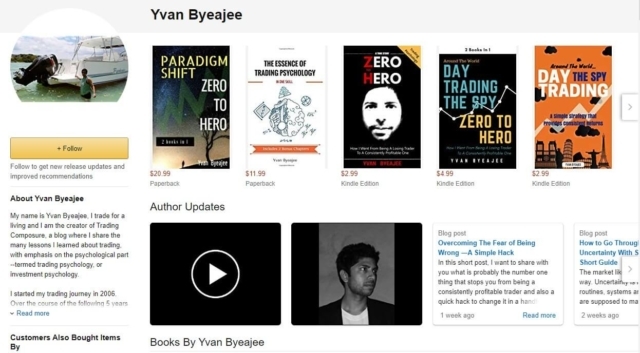

Besides, a few of our members reported that Yvan Byeajee’s Trading For A Living: Create A  Lucrative Trading Business, Travel the World, And Work For Less Than 20h/week is quite practical and useful.

Lucrative Trading Business, Travel the World, And Work For Less Than 20h/week is quite practical and useful.

Yvan Byeajee wrote several books about trading & trading mentality. His bio in Amazon says;

Yvan is also a meditation expert. He describes Trading Psychology Mastery Course (now get $50 discount) as “Stability of mind, flexibility, concentration, and non-attachment are explored in detail in this highly practical and deep home immersion trading psychology course”.

I understand you get a 20% discount if you bundle them.

Advanced Trading Course Including Risk Management

In order to be profitable in forex trading, you need to learn the advanced techniques especially the most important skill – Price Actions. Many of our members use Scalping technique which involves high leverage (typically 1:500 or even over 1:1000), means you need to master Risk-Management as well.

2ndSkiesForex – Advanced Price Action Course

The best-suggested course is 2ndSkiesForex Advanced Price Action course. The course works not only for Forex but also for commodities, futures, CFD’s, stocks, global indices and options. You get lifetime access to the course, videos, private member webinars, trader quizzes and members trade setups forum.

The course includes the risk/money mgmt section (section 5) that covers leverage and risk, particularly the mathematics behind it and how they need to approach this.

Over 50+ hours of video training is included in the course. To share the flavour of Chris’s video, I uploaded below video explaining the pros & cons of “Set and Forget Price Action Trading” (which is included in free video courses), enjoy;

Price Action Forex Trading – Scalping Course

As I said, many of our members prefer Scalping method. Scalping is a good way to make consistent profits throughout your trading session and it´s a very good style if you like to trade only on high volume periods of the day such as the London and New York session overlap.

Some of our UK members suggested Rob Taylor’s Scalping course. If you’re serious about  scalping strategy you’d better take a specialized course like this. Rob informed us that you can get huge discount now. Rob described his scalping course as;

scalping strategy you’d better take a specialized course like this. Rob informed us that you can get huge discount now. Rob described his scalping course as;

Stage 2 Model: Develop Trading Portfolio – Use Successful Forex Trading Signals

How successful is forex trading can be measured by how you can develop well-diversified forex trading Portfolio.

Top Signals Are Usually Paid Off Instantly

One way to do diversification is by using Trading Signal Services on top of your own strategy.

People often hesitate to pay the signal service partially because they don’t want to rely on others after long training and partially don’t want to pay for the service, and partially are sceptical about the quality.

However, proven signal services are usually paid off very quickly and you can actually learn from the successful signals, and above all it’s a very effective method for diversification.

So, I am sharing a few most reputable professional signal services & resources as follows (The signals being listed below are signals across all time zones because of each signal’s traders or algorithm trade almost all day. Thus the signals will be throughout the day. The bottom line is that these signals can be for any traders in the world.);

ForexSignals

If you want to execute professional trading while learning even from the basic, ForexSignals is the best solution. ForexSignals assisted nearly 70,000 Forex traders since 2012. This signal is a rare service that can hardly be found any negative review but highly rated in every ranking sites including ForexPeaceArmy where it scores 4.544 ratings out of 5 scales.

This signal service provides you with an excellent educational platform. Namely, they offer a Trade Room where you can learn Forex Trading with 3 professional Forex mentors (Andrew Lockwood 30+ years experiences / Mark Bennell 15+ years experiences / Max Norbury 10+ years experiences), including daily live streams, a global chat room, and trade signals. The service also offers a Trade Academy section including 100+ Forex educational videos and 4 MT4 tools to help with your trading. All the signals from our traders and the community are displayed in the trading room. The company is registered at Hong Kong (Address: 1301 Bank Of America Tower, 12 Harcourt Road, Central, Hong Kong 1000). Their staff are located in different countries across the globe to cover all the time zones.

You are entitled to have 7 Days Free Trial. Besides, Use ‘forex4life’ to get 10% recurring discount.

See the separate report of Most Profitable Forex EAs & Signals Full List, where we also included several specific examples you should avoid for your safety.

Stage 3 Model (A): Create Your Own Autopilot Trading with No Programming

Another important successful trading strategy is to reduce your Manual Trading by adding Automated Trading as the Further Diversification of your Portfolio.

Over 70% of institutional traders use algorithmic trading and over 90% of traders who consistently win use autopilot trading. If you want to be a successful forex trader, not using autopilot trading is not a smart approach because software/robot can eliminate any human’s psychological problems that are the biggest cause to prevent your profitable trading. Further diversification will surely improve your risk-management capability.

Professional traders create their EA based on their unique strategies. Big institutional traders use their own programmer in their resources, but you can do the same very economically & easily by using the below program;

Develop Your Own EA Portfolio Instantly & Optimize Periodically

EA Forex Academy

EA Forex Academy is run by Petko Aleksandrov, a Head trader and mentor. They provide you with algorithmic trading tools for your retail traders. As long as we see, this course is the most practical, comprehensive & value for money in this territory.

They claim to have 24,000+ students in about 160+ countries, an amazing number for just 4 staffs.

They provide a lot of video courses including Algorithmic Trading & Cryptocurrency Trading.

And the key course for creating & forming its own EA portfolio is Expert Adviser Studio. Watch the below introductory video showing the overall concept of EA Studio;

Suggest you continue to watch another video as below, which explains what you get from free registration and specific demonstrations of how to generate the trading strategies, test them instantly (you can actually save a lot of time for this) and execute them in real tradings while creating EA portfolio;

Finally, let us share a video explaining a course of Optimization of Portfolio Expert Adviser with 100 Strategies, which would be ideal for your trading diversification.

It’s suitable for busy people (it also elaborates on how the diversification works in Forex Trading). Hope this video gives you the idea of how each course in EA Forex Academy is organized;

If you want to purchase any of the course, send your e-mail address to us via Contact, then we will make sure you get 15% Discount from Petko.

Stage 3 (B) Model: Use Successful Forex Trading Robot

Alternatively, you can use the proven Forex Robot / EA developed by the professionals.

However, we should understand that there are full of scams on the Internet. I’m sure you understand ostentatious claims are often used by scammers to trick retail traders but unfortunately human tend to be dazzled. Remember, they don’t have any evidence to back up their claims.

Therefore. if you’re new to EA and you prefer to use the EA being sold in the market rather than creating your own EA introduced in the previous section, suggest go through the below information first;

Forex EA Knowledge

We have issued the below 3 Forex Robot related strategic papers;

Current List of Profitable Forex EA

We list just a few forex robots which seem to currently work well. We researched many ranking & backtesting services sites and thieved into them mainly based on;

- Survival Length Over 2 Years (2 years is the period that goes through a series of up & down market waves although a full economic cycle may need 5-6 years, means the EA can cope with normal market change with major news)

- The 3rd party verification on the trading results is available

- Low Risk – Drawdown rate is less than 20%

- Annual growth is over 20%

- Refund Guarantee

So, if you are the trader shopping around the EA in various ranking sites based on the similar parameters to the above, we have saved your time. You may want to test them for yourself by making the best use of the Refund Guarantee Period (see the best testing tools in Appendix at the bottom).

However, Forex EAs are basically not designed to (in fact almost impossible to) program rapid market change affected by big economic news, political or weather issues. Such inconsistency of the market is the biggest cause of the EAs’ inconsistent result. We select the EAs that have survived for a reasonably long period, means they equip the good risk management setting to avoid big upset by those surprise news. However, it’s better for you to monitor especially for the volatile period rather than relying completely on the automated decisions, which can definitely improve your profitability.

The most successful forex trader including institutional traders develop EA portfolio, monitor carefully and do optimize it constantly.

Flex EA

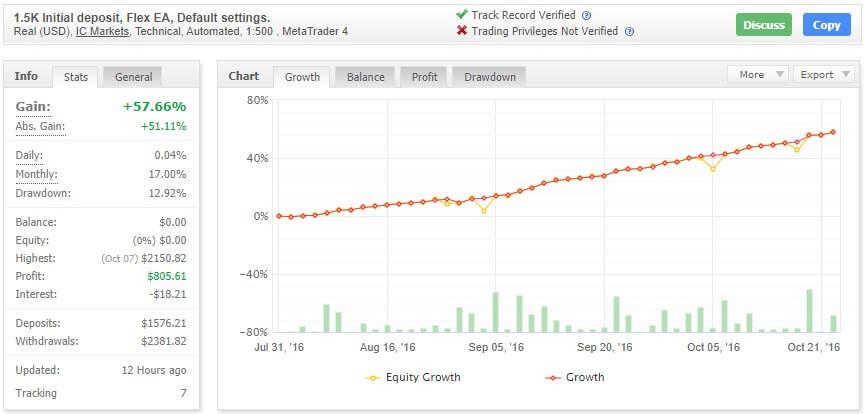

Flex EA is a highly rated EA including an automatic update system that can consistently provide profit without regularly updating the settings. In its active exclusive Forum, you can check the other members’ experience of this EA and exchange the opinions. Currently, they run a huge discount of 67% off, use the code ‘FLEX67OFF’ at check-out. The 3rd party verified results is publicized in myFXbook;

The Real-Time Trading Update is;

Forex Gump EA

Forex Gump EA was created by the team headed by Ukrainian trader and developer Andrew Kozak.uses, well-known in MQL5 community. High-Frequency Scalping Trading with 1-minute time frame, robots will work 24×5 to look for opportunities and take profits. Check the 3rd party verified results in FX Blue;

The Real-Time Trading Update is;

As said before, see the separate report of Most Profitable Forex EAs & Signals Full List, where we also included several specific examples you should avoid for your safety.

Stage 4 Model: Successful Forex Trading – Earn Commission

After you have established a well diversified trading portfolio and have good confidence on your skill & strategies, you may want to Start Trading to gain Commission by helping other traders.

Being Copied in Social Trading Platform

Just in case you’re not familiar with Social Trading / Copy Trading, you may want to take a look at;

Among many social trading networks, eToro (full Review – make sure you check 2 Successful Methods & 4 Processes) & Zulu Trade (full Review) is supposed to be the most established platforms, and they offer the following plans for you to earn commissions;

eToro

Consider to Become A Popular Investor , and get copied by thousands of eToro members to make a lot of extra money.

, and get copied by thousands of eToro members to make a lot of extra money.

ZuluTrade

You can earn handsome commissions from ZuluTrade Trader Program;

Get Investment on Your Trading as PAMM Masters

If you’re not familiar with PAMM (Percentage Allocation Management Module), suggest you take a look at;

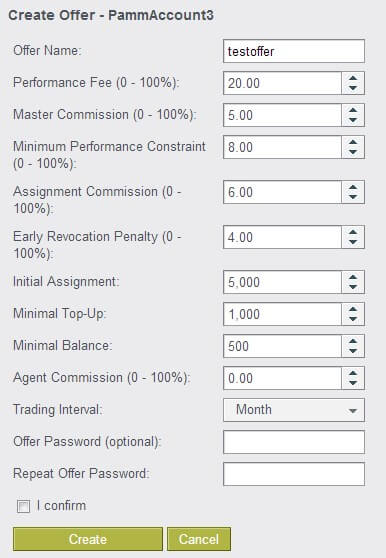

You may want to consider becoming a PAMM master trader in the below Broker which is said to be the best in this area;

FX Open

You can create your own PAMM Master Account and ask other FXOpen traders to invest on your PAMM account. You can freely set your commission structure as below;

Conclusions

Yvan Byeajee we introduced in Trading Course said;

We have shared a proven process which is designed to shorten the lengthy loss generating period which retail traders often go through as shown in the below image. The original chart is the one I used to show how hard the retail traders achieve profitable forex trading in the passive trading introduction; So, follow the model many successful forex traders including institutional traders are more or less taking and make a living forex trading if you would like.

So, follow the model many successful forex traders including institutional traders are more or less taking and make a living forex trading if you would like.

Successful Forex Trading Appendix – Useful Resources & Tools

We randomly list some other useful weapons for your successful forex trading as follows;

Strategy Back Testing

Before you execute your trading strategy, you need to test it. One of the most reputable testing software is Forex Tester, Download Free Trial;

VPS

ForexVPS

If you’re looking for the VPS hosting service with the lowest latency in the industry, ForexVPS is the company to choose. Therefore, once you purchase your expert advisor, consider using it

Good Luck!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment

For newest news you have to visit world wide

web and on internet I found this site as a

finest web page for hottest updates.

I’m not that much of a online reader to be honest but your blogs really nice, keep it up!

I’ll go ahead and bookmark your website to come back in the future.

Cheers