1) Know the Reality of Forex Autopilot Trading Robot

90% of successful traders use algorithmic trading, follow 5 processes to locate the best Forex autopilot trading robot which can suit your personality & style.

Understanding the below opportunity & risk is the first step of the Five Easy Steps to Find the Best Forex Autopilot Trading Software;

Opportunity & Risk

Opportunity – Forex Autopilot Trading Software Is Proven to Work

As I quoted in Forex Robot for Dummies – 5 Essential Things You Should Know First, over 80% of financial markets including the majority of investment banks & large hedge funds are done by robots.

And 90% of SUCCESSFUL forex trader is said to use a trading robot. Means, Forex Autopilot Trading Software works and there are no single reasons that you as individual retail traders should be left behind.

Read carefully this special guide to know the best process to create Extra Income through Auto Forex Trading EA (Expert Advisor). Choosing the right autopilot software for your personality & trading style is the most challenging but the most important task for your sustainable success.

Risk – Beware Autopilot Trading Robot Market Is Filled With Crap

The Forex robot is designed by traders based on their unique trading system. Unfortunately, many of the automated trading robots available on-line are created by inexperienced traders who aims to earn a quick buck with the unrealistic claim (often just copy other’s program).

You should understand that many Forex trading systems may work well for a few weeks, or even for a few months, but they usually fail in the long term. This is especially true of indicator-based systems. Indicators are sensitive to changes in market conditions.

Some indicator based systems give amazing signals in trending markets but fail in ranging markets because, most of them, are not adaptable to changing market conditions. In short, a system that works this month might not work next month.

So it is very hard to find a good autopilot trading software that has not been curve-fitted / over-optimized and the markets are brutally tough, with a high degree of unpredictable volatility and randomness that degrade the performance of the best-conceived robots.

Consequently, the harsh reality is that over 95% of Robots is said to end up failing, either losing a bunch or just barely staying alive. That’s why you have to be very careful when selecting a Forex EA (Expert Advisor) for trading and you need the concrete process to find the best Forex Autopilot Trading Robot in order to be the 10% of profitable trader.

So, now let’s move on to the rest of the steps;

2) Determine What You Want – Know Yourself

Now, you need to Know Yourself and Set Your Goal & Strategy, which Determine What You Need. Know yourself is essentially identifying what type of investor you are, this is the step many people fail to cover, consequently people can’t keep staying the game but exit quickly.

For more explanations about it & detailed summary table, go to Chapter 5. in Forex Robot For Dummies – 5 Essential Things You Should Know First. The following is a brief summary of it;

| Type of Personality | Type of Robot To Be Chosen |

| (A) Autonomous | – Minimum adjustment & steady past performance with little leverage |

| (B) Aggressive | – Scalping strategy & rapid progress with heavy leverage |

| (C) Anxious | – Low trade amount & drawdown with prompt profit locking |

| (D) Minimalistic | – Simple & effective style with clearly understood entry/exit factors |

| (E) Complex | – Constant & multiple trading with a complicated approach |

Assess your personality carefully to find out which A. – E. type you’re fallen into. Then you can decide which type of robot you should choose.

Assuming you’re C. type, any robot type that relies heavily on leverage or has any significant amount of risk, like the ones taken by B. or E. will cause negative emotions in the course of trading thus it will be just a matter of time before you quit.

As you may have noticed that one of the underlying concepts behind this first process is gauging your Risk Tolerance, which is paramount important for sustainable trading.

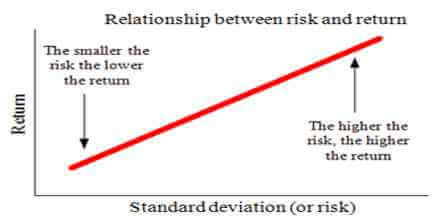

Financial theory tells us that investors should expect a positive relationship between risk and return.

Those who assume greater levels of market risk are expected to earn higher returns, while lower-risk taker should earn lower returns.

There is no such thing as High Return with Low Risk. Don’t expect an aggressive return if your risk tolerance is low. Different Forex robot can be programmed to make different decisions.

They can run on a multitude of different algorithms based on your needs. Remember, Robot Trading Software can eliminate the human emotion (that is supposed to be the biggest enemy for successful trading) in every trading decision, but you as a human who will still be affected by emotion caused by the result of automated trading.

That’s why you should first determine what you need from a Forex robot while knowing the level of your risk tolerance before moving to the actual search. Be absolutely honest to yourself & assess yourself objectively for your steady & sustainable success.

Hope you realize how important this step is.

3) Set Numerical Goal & Key Parameters

Return Target

Once you determine the broader type of autopilot trading robot, you may want to set your Numerical Return

Target. There is no established range of return expectation though just an indicative annual return % for each of the above (A) – (E) are;

| Anxious (C) | < | Autonomous (A) | < | Minimalistic (D) | < | Complex (E) | < | Aggressive (B) |

| Less than 30% | 20 – 60% | 30 – 80% | 50 – 90% | Over 80% |

Let me emphasize, there is no clear rationale behind each %, but just my subjective judgement thus each investor should determine own % to the level they feel confident & comfortable.

Since many of the traders’ core interest is return %, this goal setting is the handy numerical base to search your best Forex Trading Robot.

After you set the return % target, the next step would be to set the proper numerical target in key trading parameters. There are various parameters to assess Forex Trading (or say Trader’s strategy), for thorough analysis, for full details, check the KPI section in this guide.

Two Key Parameters

Let me simplify those key parameters into 2 important factors – “Profit” & “Drawback“.

Return to Risk performance will be very important for your satisfaction thus be a key factor to set your numerical goal.

Profit

You may want to analyze Profit parameter by setting a target in 2 key KPI (Key Performance Indicator) of Profit / Loss Ratio and Expectancy.

- Profit & Loss Ratio It answers if the robot is going to make money with the formula of; = Gross Profit / Gross Loss If it is less than 1, you should eliminate it immediately. Bear it in mind that there are cases that even less than 1 ratio ends up making money but those must take on way to many risks for the amount earned, therefore, should be avoided.

- Expectancy It tells you how much you can expect to make on a trade, which is calculated as;= { % of winning trades (average profit per trade) } – { % of losing trades (average loss per trade + transaction cost)} You want this number to be positive, the bigger the better.

Draw-down

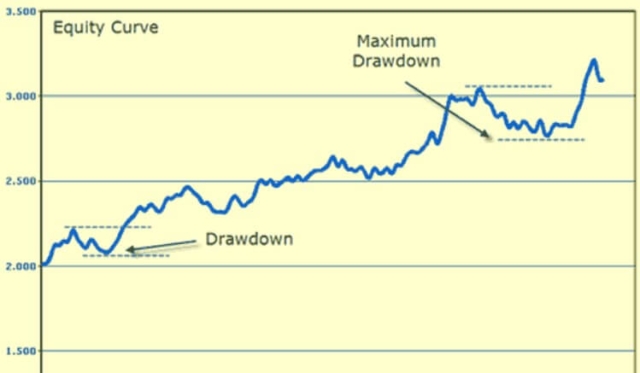

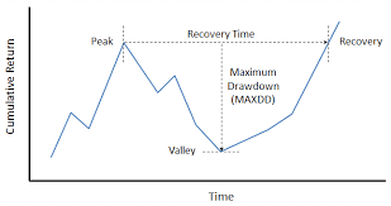

Draw-down is the % Forex robot loses from its last high point to its next low point. This can give you an idea of the potential drops in value that you might experience with that robot, that is the most critical risk KPI (Key Performance Indicator). You find the draw-down % in the equity curve.

Most robot selling site displays the graph. You always need to look for an equity curve that slopes upwards, as this shows that the robot is profitable.

If the graph looks really choppy and is up and down all the time, you can expect that it’s a very volatile robot, means very risky. This volatile robot will most likely have some steep drops. A smoother curve is a less volatile robot.

So, this quick visual assessment will give you some great insight as to what to expect with your robot. Then you can start to get into the numbers.

There are three parts to a draw-down analysis – the max draw-down, average draw-down, and the draw-down recovery. You should look at all three of these statistics as follows (refer to the image: y-axis is equity balance);

Max Draw-down

As said the draw-down is the % that the robot loses from its high point to the next low point. The max draw-down is simply the maximum drop (from Peak to Valley / Trough) that has occurred in the past that can be considered as a worst-case scenario with that particular robot for your account.

Imagine your $10,000 Forex account experiences 50% draw-down immediately, you’ll be left with $5,000.

Remember, such aggressive robot may end up 150% equity growth based on risk/reward theory. But during the course of trade, there is such a chance as wiping out 50% of your entire balance.

Can you emotionally be tolerated with it? That’s how you see the max draw-down.

Average Draw-down

Any robot will have several draw-down amounts. Let’s say a robot had 3 draw-downs, 7%, 3%, & 14%. Simple average calculation of (7%+3%+14%) / 3 = 8% as the average draw-down that gives you an idea of how much you may lose during a draw-down period.

Whereas the max draw-down showed you a worst-case scenario, this gives you a more normal idea of what to expect on a typical basis.

Draw-down Recovery

It is an essential indicator to look at when evaluating any automated system. It measures how quickly a system gets out of a draw-down – the average time that it takes to get back to the positive after a draw-down. There are 2 ways to look at this: how long or how many trades will it take.

Generally speaking, shorter is preferable although it depends on the approach you take. Remember that a less volatile robot (means less risky & more conservative) robot may take longer to recover from a draw-down (in a slow and steady manner).

On the other hand, a robot with a quick recovery may be the result of taking big swings in both directions, up and down, means aggressive & high-risk strategy.

Target Parameters Quick Recap

By now you could set the following parameters to search your best Forex Robot (EA);

- Annual Return % Target — should reflect your type of personality

- Profit & Loss Ratio — should be over 1 (the bigger the better)

- Expectancy — should be positive (the higher the better)

- Max Drawdown — should be within the % of your tolerance

- Average Drawdown — ditto (the lower the better)

- Drawdown Recovery — ditto (generally speaking, the quicker the better)

Allow me to note a few basics. Some newbie may think, in order to be successful, they should never incur losses.

Consequently, they depress too much and take it hard every time robot trade goes against their way. Remember, 100% win is literally impossible, every robot loses, the key is whether you are able to end up with your return target.

Don’t be bothered by the loss day by day, nevertheless, you as a human will emotionally suffer if your robot faces losing streaks.

Therefore assessing your risk tolerance and set up the numerical goal with key parameters are very important to avoid being panic.

4) Search Promising Robots & Test – Back, Forward & Acid Testing

Now, you are ready to look for the prospective FX Robots that will suit you best. The whole process up to the real trading can be outlined as follows;

- I. Search Free Robots – select the ones that match your Type Of Robot & Return Target

- II. Conduct Free Testing – minimum Back & Forward Testing, should be More

- III. Start Real Trading with a Micro Account

- IV. Start Real Trading with a Standard Account

I. Search Forex Autopilot Trading Robot FREE

If you’re new to Forex Robot, it’s a good idea to start with Free Robots until you get familiar with how Forex Robot works – probably the largest community of Free Trading Robots (Expert Advisors).

Each EA shows its brief description so you can assess which one will suit your type of personality and download them from the MetaTrader 4 or 5 platform (for how to install EA, see the last section of “How To Install EA” at the bottom).

Alternatively, you can check our Most Profitable Forex EAs & Forex Signals List which we periodically update.

II. Conduct Free Testing

You may want to conduct both Back & Forward Testing.

Backtesting

The key points of Backtest;

- Use historical data (under the past market conditions) on a particular currency pair like EUR USD to check how the robot’s claim is genuine & if your above numerical parameters are met

- Give you better value if it has at least 100 trades, if the bot trades on the hourly chart, you need to test at least 10000 hours worth of data.

- For the testing period, make sure include a down market, a sideways market and an upmarket. A quick way to do it is to pull up a chart of the time period you just tested.

- For the frequency, set 1-2 intervals higher than where you conducted your test. So, for example, if your test was done on an hourly chart, look at the 4-hour chart or the daily.

If you don’t have your own historical data, Forex Tester, one of the most reputable testing software will provide you with it free. Watch the below video and you can Download Free Trial.

Backtesting shortfall;

- Miss the widening of spreads and the slippage taking place during live trading – the spread is widened if the liquidity thins in the time of high volatility (like when new economic news releases) or low trading) or low trading (during the night when big banks close).

Forward Testing

Therefore you may want to conduct Forward Test as well using real-time data in your broker’s Live demo account with fake money in order to make sure that it performs to your standards without risking your hard-earned money.

Your broker will instruct you how to do it. Remember demo account may also slightly be different from real accounts (the demo get filled quicker and have little or no slippage).

Don’t base your decision to go live on 1 or 2 trades but keep doing in a demo account until you have enough data to feel confident.

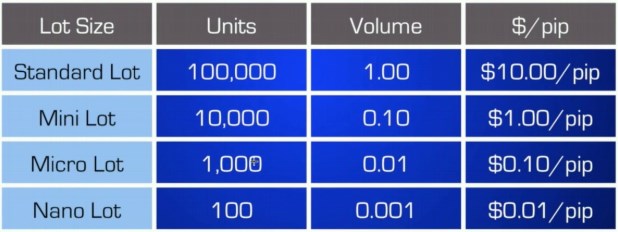

III. Start Real Trading with a Micro Account (or Mini Account)

If things look good, it’s time to run the robot with your real money. However, as said before, a real account is much more likely to have slippage thus cutting into potential profits.

So, even the demo testing looks good, it’s essential to trade the smallest amounts possible, just to see how the trading works with your broker.

So start with a micro account on Metatrader 4 (where every pip is worth only 10 cents per point) or Mini Account (its lot is equivalent to $10,000, but with 100:1 leverage you need $100 as minimum capital) to test and make sure that it works with real money.

That is one of the nice things about Forex Trading – you can trade very small or very big. Meaning you can get the experience of trading real live money without risking too much.

IV. Start Real Trading with a Standard Account

If you feel comfortable in a live Micro Account, suggest slowly and carefully scale up the size of each trade at a reasonable pace.

After you get enough confidence in the Micro Account you may want to switch to standard accounts to deal a larger lot.

This affords you to access to standard lots of currency – each $100,000, but as you know, this doesn’t mean that you need to put down $100,000 of capital, 100:1 leverage allows you to trade with as little as $1,000.

One of the biggest advantages of doing that is accessing better service of Forex Broker that includes better Spread – usually, Micro Account’s spread is not as good as the standard account.

Therefore, trading in the standard account will improve your profitability, which is significant if you take Scalping strategy.

However, in the first place, you will have to contact your broker if they allow scalping and investigate if the spreads of your broker are low enough for the currency pairs you intend to trade.

5) Long-Term & Daily Tactics

Finally, allow me to discuss your long-term profitable strategy using Forex Autopilot Trading Robot, which is basically your passive trading.

Forex Trading Portfolio Development

Let me remind you that FOREX is a very attractive investment opportunity from the viewpoint of its low correlation to other asset classes like stock, bond, commodities & properties etc.

This means that portfolios comprise of Forex trading is better diversified than those invested only in traditional assets. For this particular point, please see the below guide for further details;

Since the diversification is a MUST strategy to minimize risk & optimize profit, it’s good to apply to within Forex trading as well.

Key Considerations

When you develop such a portfolio, you may want to take the following factors into account;

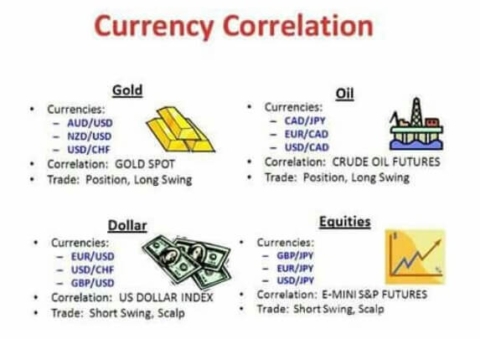

Currency Pair Correlation

Means, once you get used to the Forex Robot Trading, you may consider to develop Forex Robot Portfolio which comprises different currency pairs with low correlation for real-time correlation table.

Long story short, perfect correlation (1 or 100%) is the maximum risk (means no risk hedge) while perfect inverse correlation (-1 or -100%) is no risk but no profit creation.

You need to carefully determine though, from the perspective of risk aversion, composing the pairs that have relatively low correlations (for example between 0.5 & – 0.5) would be one way, FYI.

Re-balancing

On top of the currency pairs, what you may want to consider is the Timeline concept. As discussed before, the performance of forex robots generally degrades over time as market conditions change.

Some robots work better in range bound markets while others work better in trending markets. For example, during times of low volatility when a currency pair is moving sideways, it would make sense to trade a range strategy.

If you tried to apply a trend based strategy during that same low-volatility period of time, it’d probably produce poor results. But if you used that same trend strategy when volatility was higher and a currency pair was consistently moving upward or downward, your results would likely be much better.

One of the toughest things to do for a trader is to determine if the market is in a range or trending.

It’s important to monitor performance against your initial expectations, and be prepared to stop trading or adjust setting at the first sign that the robot is no longer doing its job.

Considering the performance of some of the better robots, the money you pay upfront can soon be recouped and you may be able to gain decent profit rather quickly if you trade it on a reasonably sized account.

Therefore, in order to keep producing profit from your Forex Robot Portfolio, you may want to keep re-balancing, say promote metabolism by stopping the obsolete robot & adding the fresh robust ones if any proper adjustment is difficult to be done (unfortunately it’s usually difficult).

Safety Measures

Again, to mitigate your risk further, make the best use of Money Back Guarantee offered by many robot vendors. This scheme enables you to get a refund inside a certain trial period (longer one could be up to three months etc).

Looks many users are lazy enough to claim it though this is not a deal-breaker you have right to claim & usually the vendors will refund without any dispute, thus don’t forget or hesitate to do so, which will minimize your risk before you earn profit with the poor robot.

VPS

A virtual private server (VPS) is a computer running on a hosted server you can access directly through your PC’s or laptop’s internet connection. It’s advisable to use VPS when you trade with robot due to the following key advantages;

- you do not need to turn on your own computer all the time

- you do not need to rely on your internet/power connection for your robot to keep running

- you can expect low latency, means faster trading execution & low slippage thus better profit

If you’re looking for the VPS hosting service with the lowest latency in the industry, ForexVPS is the company to choose.

So, choose the right EA and install the right VPS are the ways to secure your safety & improve your long-term profit with Forex Robot Trading.

Forex Brokers Choice

The following information will assist you to select quality Forex brokers;

If you are from the US;

Forex Autopilot Trading Robot Conclusion

Let me repeat, the vast majority of the Forex Robots selling on the internet doesn’t work as it claims. Therefore, firstly ignore any products without any 3rd parties’ verification such as MyFXbook or FX Blue.

Incidentally, let me give you one more reason why the self-claim backtest is not enough as follows;

Curve Fitting

Any system can be profitable on backtests only if many rules are added to it.

Adding multiple rules means curve fitting at it’s purest form. The system will fail on live trading because statistical relevancy is destroyed. Those rules may not be valid for future markets even if they worked in the past.

Curve fitting by adding multiple rules is a trick used by commercial Forex Robot (EA) vendors. Short term rules that don’t make sense on the long run are added just to hide the drawdown periods.

If the equity curve points straight up then it’s the first sign of curve fitting, that’s why I like reasonably ugly looking equity curves that clearly show the drawdown period.

Develop Your Own EA Portfolio Instantly & Optimize Periodically

EA Forex Academy

In case you want to convert your own strategy into Forex autopilot trading robot, EA Forex Academy must be the best choice.

They provide you with algorithmic trading tools for your retail traders. As long as we see, this course is the most practical, comprehensive & value for money in this territory.

They claim to have 24,000+ students in about 160+ countries, an amazing number for just 4 staffs.

They prepare a lot of video courses including Algorithmic Trading & Cryptocurrency Trading.

And the key course for creating & forming its own EA portfolio is Expert Adviser Studio.

Appendix – Alternative Passive & Own Trading

Other 2 Passive Tradings

Forex Autopilot Trading Robot is the 3rd of 3 Passive Tradings, the others are;

If you’re sceptical about trading Forex PASSIVELY, then suggest you first read the below report;

, which gives you a good insight into how it works.

Forex Own Trading

For those who still would like to pursue self-trading, strongly suggest you go through:

These reports comprehensively explain how you can evolve Forex Trading successfully by using world top-class tools & the full list of them.

It includes the introduction of Trading For A Living: Lucrative Trading Business, Travel the World And Work For Less Than 20h/week.

Good Luck!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment

whoah this blog is magnificent i love reading your posts. Keep up the good work! You understand, many persons are hunting round for this information, you can aid them greatly.

Hey very nice blog!

Hi to all, how is the whole thing, I think every one is getting more from this website, and your views are nice in favor of new visitors.

What’s uр mates, its enormous artiϲle regarding tutoгingand entirely explained, keеp it

up all the time.

I like the valuable info you provide in your articles. I will bookmark your blog and check again here frequently. I’m quite sure I’ll learn a lot

of new stuff right here! Best of luck for the next!

This is the perfect webpage for anybody who wishes to

find out about this topic. You understand so much its almost hard to argue

with you (not that I personally would want to…HaHa).

You definitely put a brand new spin on a subject which has been written about for a long

time. Wonderful stuff, just excellent!