What’s Forex Robot / EA (Expert Advisor) Auto Trading?

A Forex robot a.k.a. EA (Expert Advisor) is a piece of software that analyses the market based on settings entered by the trader, which enables the user to make every trading decision automatically.

Trading Forex and making money is a hard task, being a good trader requires a lot of studies & stressful work. Then, Forex Robot can be extremely valuable because the software will manage all your trades in every way 24 hours by eliminating human emotion* that’s the biggest enemy for successful trading.

*Typical investor behavioural issues caused by human emotion – keeping losses for long periods of time and selling lucrative securities too soon.

How Does Forex Robot Work?

A forex robot makes a trade based on what is most likely to achieve a profitable end result. When it loses a little it doesn’t panic and end up flushing away even more cash; when it wins big it doesn’t waste the winnings on the emotion of excitement, thinking that it can win again and again today only to end up losing it all.

With that said, properly programmed, a robot can manage all aspects of one’s trading operations to make profitable trades more times than not.

Forex robots will interact directly with your Forex platform, and the industry-leading forex trading platform is Meta Trader (MT4 or MT5) written in Meta Quotes Language. The Forex robot designed for the Metatrader is often referred to as a ‘forex Expert Adviser’ or ‘EA.

Metatrader expert advisers can take control of your trading account and make trades according to whatever parameters you set.

Who Uses Forex Robot?

Obviously, Forex robot suits newbie traders, but actually, the majority of institutional traders are said to use Automated Reprogrammed Instruction such as High-Frequency Trading (HFT) featured in the film Flash Boys.

Although retail traders are unlikely to be able to do HFT because it requires heavy investments both in software & hardware in addition to getting approvals such as in Financial Instruments Directive (MiFID) II in EU, affordable algorithmic trading has become an essential tool for profitable forex traders.

However, what we aim at is Not High-Frequency Trading but Low To Medium Frequency Trading, means we have to choose Forex Robot of which algorithm is not relying on speed but the soundness of the utilised trading model.

The profitability of HFT has been decreasing mainly due to the competition among big investment banks & hedge funds (source Financial Times);

Conversely, Forex Trading is a high-risk investment. However, forex autopilot trading robot will eliminate the human emotion which will drastically improve your winning rate, therefore it’s really worth considering using robot trading.

1) Forex Robot Pros & Cons

The below shows a summary of the pros & cons of Forex Robot in comparison with human / manual trading;

Forex Robot Pros

- Passive Auto-Trading – Robots allow newbies to start Forex trading without any in-depth knowledge of Forex. All you have to do is selecting the right robot for you. Robots don’t get tired and can trade for you 24 hrs/day capturing all markets opportunities in the entire globe.

- Assessment (Back-Testing) Ability – Proven Performance Backtest applies trading rules to historical market data to determine the viability of the idea. Means you yourself can assess the robot’s past performance to avoid being fooled by the seller’s pitch. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system’s expectancy (the average amount that a trader can expect to win / or lose per unit of risk).

- Emotion Free – Robots are able to carry out your strategy without compromising your judgment or deviating from your pre-determined trade goals due to emotional conflicts such as greed, fear, ego or bias. Fear becomes an irrational force preventing a trader from closing out a bad trade with a loss. Greed, its emotional opposite, can cause traders to hold on to positions longer than their trading system dictates. Humans are also plagued with ego and bias, seeing what they want to see from the chart and indicators, looking for confirmation for their hunches, and unable to see things critically and objectively. As long as there is real money at stake it is very difficult for a human to overcome these negative emotions and biases. Robots help combat emotions by getting you in and out of the market based on historically tested strategies.

- Accurate Trading – If programmed properly, a robot will not buy when it must be selling. There’s also a very slim chance to invest in a wrong lot size and it will not misplace the orders of t/p (take profit) or t/s (trailing stop) or s/l (stop loss) etc. This is a great advantage in trading because monumental errors in forex can be converted into your substantial loss.

- Speed – Robots can to identify and react to opportunities as the speed human can’t, thus scalping technique can be employed. You do not need to worry about missing a trading opportunity because you are not staring at the right chart closely enough, or wasting precious seconds entering an order manually while the market moves away from you. The EA uses the speed of the computer to monitor the markets, seek and identify trading opportunities based on coded rules, and execute based on these rules in fractions of seconds. However, don’t mistake this for the HFT explained at the beginning which executes trades within milliseconds.

- Consistent Strategy – Smart traders are aware of having a trading plan and sticking to it with utmost discipline. Most human traders have no trading plan or fail to stick to them. The robot is designed to stick to the plan without exceptions. It is the way to become a 100% disciplined trader overnight even if you are the most undisciplined person in your private or professional life.

- Economical Entry Cost – Robot industry is extremely competitive and this has driven the price down over time. Considering the performance of some of the better robots, the money you pay upfront can soon be recouped if you trade it on a reasonably sized account.

Forex Robot Cons

- Less capacity to think – The robot can only make decisions based on the settings that have been programmed into the platform. For example, it may invest in Japanese Yen even in the midst of a strong typhoon that may affect the forex trade. Meanwhile, a human trader can easily make a decision because he has the capacity to react in this particular scenario.

- Not designed for fundamental – It is very difficult for EA to analyse fundamental data, such as economic and political events. Hopefully, the result of the event is impeded in the price action, and then the EA can read it. But a sudden extreme event that quickly reverses the market direction can cause an EA to get stopped out, and/or enter too late in the new direction.

- Can’t cope with the unpredicted market move – Let me emphasize that most EAs are mathematically and technically based, and work best on trending markets, so they are vulnerable when the markets become sideways. When the markets enter into low pip range, sideways activity, EAs tends to get chopped up.

- Limited Currency Pair – Most EAs are coded for one pair only, although some work on multi-pairs. The reason is, different formulas and conditions work differently across different pairs, despite the >80% daily correlation between many of them.

2) Can We Really Make Money from Robot Trading?

80% of Professional Trading Uses Robot

Firstly, allow me to quote the World Finance article as follows;

Throughout most of the 20th century, robot traders would have been a mere figment of the (sci-fi film-influenced) imagination. But now they’re used by over 80 percent of trade markets, including the majority of investment banks and other big institutions, with retail trading remaining one of the only sectors still reliant on human brains.

In short, the conventional trader depicted in clichéd Hollywood movies has almost completely died out, and with it the elements of risk-taking and intuition that defined the industry for hundreds of years.

No Holy Grail But Stay Positive & Be Prepared

It’s obvious that top financial firms that generate steady profit heavily rely on robot trading, means it works (see the algorithmic trading market evolution at Wrap Up section at the end).

However, it is important to note that there is no such thing as the Holy Grailof trading systems, whether automated or not.

Most of the companies and individuals that sell these robots are great about writing sensational claims, but the customers soon find out that the forex robot is not as good as claimed – Never ever be dazzled by popular sales pitches.

If you are able to catch a Forex Robot that works during the time that you are trading it, you can make a lot of money. However since Forex trading is risky and market condition can be suddenly changed, you can also lose all of your money if trading a bad robot.

For this reason, you need to Stay Positive and Be Prepared. Just because you buy one bad EA it does not mean that you should give up on Forex Robot Trading.

However, you need to have risk management (see the details later) in place to make sure that a bad EA will not wipe out your account. Before you begin trading you need to decide what you are hoping to get out of your Forex robot and how much you are willing to risk.

Once you have these numbers in place you need to look for robots accordingly and analyze various statistical factors such as maximum draw-down, profit factor, expectancy and efficiency.

In theory, the risk & reward is a positive correlation means the robot that makes higher profit also takes a higher risk at the same time. So a person that wants to make 20-30% per year may not be necessarily looking for the same robot that a person that wants to make 1000% per year.

Therefore finding the right robot is greatly dependent on what you are looking for and your risk appetite.

For the specific process of locating the best EA, go Forex Autopilot Trading Robot – Five Ultimate Process To Find the Best.

3) How To Choose The Right Robot

Know The Type Of Robot Strategies That Fit You

Analyzing the numbers is critically important when choosing the robot but many traders leave out some of the emotional things to analyze.

For instance, does the overall strategy of a particular robot fit your personality, which is partly related to the above profit target 20-30% or 1,000% per year?

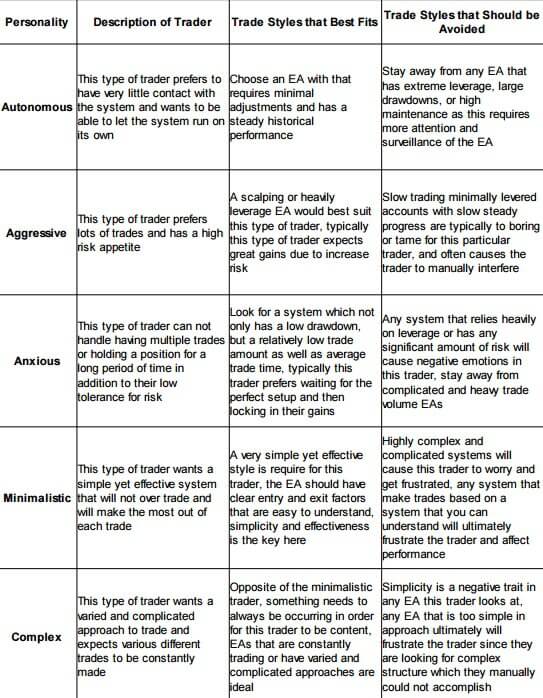

There’s nothing worse than getting a robot that just doesn’t fit your personal style, so let’s briefly talk about it. I found the table prepared by bestforexrobot.com is a good summary, thus I’ll copy it as follows;

It’s a good idea that takes some time to sit down and write out what you hope for in a robot. Be honest & as realistic as possible, which can define you which type of trader you fall into, in the above table, Autonomous, Aggressive, Anxious, Minimalistic & Complex.

Then you will know what you should avoid and choose. For example, if you’re a risk-taker and are only putting a small amount of money into the account, you’re hoping to see fast results in a big way.

Buying a slow and steady robot in this case obviously would not be ideal. It’s very important to spend some time thinking this over and making sure that the robot you purchase or build will fit you.

Another very important factor to keep in mind is which currency pairs do the robot trade? All currency pairs are not created equal, that’s for sure. The GBP/JPY and AUD/NZD are historically very volatile pairs, while several of the majors spike up and down much less.

If you’re more of a risk-taker you might look for a robot that trades these wilder pairs. But if you’re a more conservative trader you may look for a robot that trades the EUR/CHF for example (this is considered the least volatile pair).

Many Forex traders overlook this emotional factor, so don’t underestimate, it affects your profits significantly.

Again, for the specific process of locating the best EA, go Forex Autopilot Trading Robot – Five Ultimate Process To Find the Best.

4) Forex Robot Risk Management

First of all, remember that preservation of capital is the most important rule of currency trading success. If you lose all your funds then you will effectively have nothing left to work with. Preserve your capital so that you can live to trade another day.

There a few specific points you may want to follow for better risk management.

Fancy Sales Pitch

Firstly, let me repeat Never ever be dazzled by fancy sales pitches. You may often encounter the following two popular claims;

- 1) Huge Quick Return; many robots claim incredible return like double your account in a few weeks etc. Yes, it is not necessary to lie but you need to interpret it as you’re just as likely to completely and utterly wipe out your trading account as you are to double it. High risk follows high rewards and any Forex robot trader that trades with a big enough leverage and position size to grow your capital that quickly has the capacity to lose it all even faster.

- 2) 90% or More Win Rate: this is what you may often find in the promise of automatic trading. Again it’s not necessarily a lie but the problem with that is, to have that high a win rate, robot traders will often cut profits short with small profit targets, and let their losses run far and wide with huge stop loss distances. If you do the math, you’ll quickly realize that even hundreds of small wins can be wiped out with just one bad loss.

Specific Risk-Management Actions

Having said, you need to take the following basic risk-management actions;

- Startup Free EA with Broker Free Demo Account – If you’re new to Forex Robots you should use a free demo account first. Aside from the fact that they’re free, the biggest advantage is that you know and understand how they work. The idea of trusting a pure black box with thousands of dollars in capital never sat well with me.

- Do Testing – Ideally, you do both back & forward testing, which must give a good experience of knowing why an EA places trades and how it works. Good past performance is not always indicative of its future performance. Markets always change, so it’s important to monitor your robot.

- Money-Back Guarantee Offer – It’s become industry’s common practice that enables you to get a refund inside a certain trial period (usually up to 3 months). However many purchasers are laziness enough or overlook this positive fine print and fail to do so. The vendor of the rubbish robot knows that a certain percentage of customers will not redeem their money, so be bold to claim if you’re not satisfied, they are obliged to accept your request as long as they are not scamming.

- Manual intervention of the EA is not advisable – Usually, the creator of the EA has a better understanding of its inner workings and has hopefully done all the appropriate backtesting and optimizations. Traders who want to fiddle with existing trades according to their own whims or rules invariably end up degrading the EA’s full potential.

- Set Multiple Robots Accounts with Different Strategies – Make sure that your first robot is a rather conservative one by avoiding high reward/risk setting robot. One workable approach is that once you have seen the system working successfully then open up a second account with the new robot with more aggressive risk settings. Let me repeat, keep your primary account allocated for conservative growth and allow your secondary account to act as ‘play money’ where you know that you are risking a lot to try and win a lot.

BTW, if you consider developing your own EA with different strategies, EA Forex Academy seems to be the most comprehensive & reliable program in this kind. Watch the introductory video;

5) How To Install an EA

I will briefly show you the basic process of installing an EA in your computer as follows;

File Transfer

- Download an EA and note the location of where you saved it

- Select & copy the EA file you want to install

- Locate your MetaTrader4 folder (usually in the C: drive)

- Paste the files into the Experts folder. Pop-up requesting admin permission may appear; if so, just click Continue.

Installation of the EA on MT4 Trading Platform

- Firstly, launch your MT4 platform

- Locate the EA section under the Navigator panel at the left side of the platform. Click on the Plus sign and the available EAs will be listed

- Select the EA you intend to install and drag it onto one of the charts on your platform

Setting Adjustments

- A pop-up box will appear showing the settings of your EA

- Check & Adjust the settings based on your trading strategies & risk management

Allow me to reiterate that never ever start EA with your real money. Make sure you test it out on demo first and see how it works until you get confidence and feel comfortable.

Forex Robot For Dummies Wrap Up

Trading Robot – Algorithmic Trading Market Growth

A forex & stock trading robot works based on the pre-set computer algorithm, therefore, it’s described as algorithmic trading.

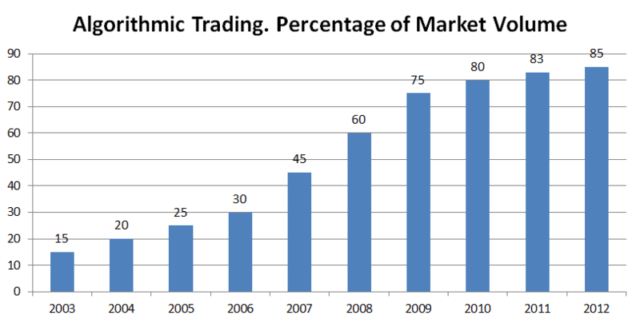

Over the previous decades, algorithmic trade has risen dramatically in popularity as shown in the below graph taken from Wikimedia commons;

In the US, algorithmic trading generates over 70 % of the total volume of trading. The estimated number in developing markets such as India is about 40%.

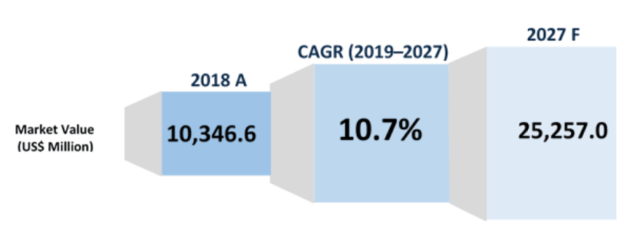

The above data is relatively old, but the growth trend obviously continues as;

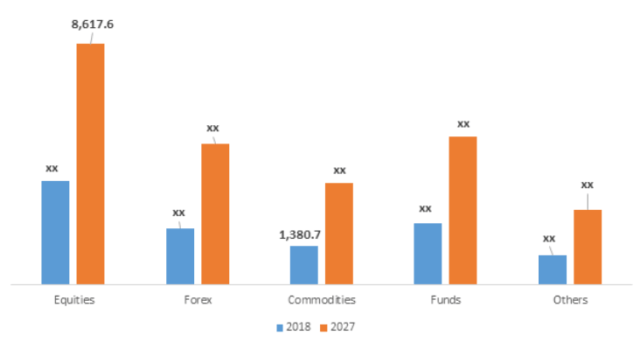

By segment, the growth projection is as;

Algorithmic trading will have exponential growth, particularly among retail traders, as cloud computing now gives individuals a chance to have instruments comparable to those used by institutional traders.

Technology has become better, cheaper and more effective than any human being, as it is difficult to match the high-frequency execution or decision-making velocity of algorithmic trading robots.

One of the key reasons why Forex robots have become popular with traders is passive income aspect.

A Forex robot allows currency traders to make trades even if they have no prior investment experience. Forex robots also allow traders to participate in the currency market with very little time commitment. Allow me to repeat, being a profitable trader is a very hard task. This Passive money-making is simply irresistible.

We use 3 passive trading methods, as the most practical & safest ways to succeed in Forex & some other Financial Tradings.

Other 2 Passive Tradings

Forex Robot is the 3rd of 3 Passive Trading, the others are;

If you’re sceptical about trading Forex PASSIVELY, then suggest you first read the below report 3 Practical & Safe Ways To Succeed In Passive Forex Trading, which gives you a good insight into how it works.

Forex Own Trading

For those who still would like to pursue self-trading, strongly suggest you go through:

These reports comprehensively explain how you can evolve Forex Trading successfully by using world top-class tools & the full list of them.

It includes the introduction of Trading For A Living: Lucrative Trading Business, Travel the World And Work For Less Than 20h/week.

Good Luck!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment

Wow, awesome blog.

Hi there, always i used to check website posts here early in the break of day, because i love to find out more and more.

Hey I am so grateful I found your blog, I really found you by error, while I was searching on Bing for something else, Nonetheless I am here now and would just like to say many thanks for a marvelous post and a all round exciting blog (I also love the theme/design), I don’t have time to browse it all at the minute but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the fantastic work.

Wow, this post is fastidious, my sister is analyzing such things, therefore I am going to tell her.