Safe Passive Forex Trading

Forex is a huge and very competitive market. Forex active trading without proper training is A Fool’s Errand, suggest considering Passive Forex Trading, which is to use the expert’s knowledge & skill in our definition (we discuss its details in Passive Income Trading).

Is Forex Trading a Good Source of Income?

Firstly, let’s discuss Why Forex? In case you haven’t read 3 Clever Ways To Diversify Your Income For A Rainy Day, suggest you do because it explains the whole background & rationale behind why you need Extra Income from Passive Forex Trading.

Anyhow, let me excerpts a few points;

- You have “Want To Learn” needs. Trading Forex will automatically make you pay much more attention to global politics, economies and general money market, which will obviously take your financial literacy to the next level. Remember, I am not asking you to trade by yourself, however, believe me, that once you put your own money into Forex market, your attention to those topics will increase rapidly, therefore your knowledge will improve dramatically, consequently, you will be able to expand your friends & networks automatically.

- You need something that has little correlation with popular financial asset class such as Stock or Bond which people usually have in their portfolio. Stock and Bond has little or negative correlation with each other, means when the stock goes south bond is not necessary to go south or even go north. That’s why the combination of stock and bond is good. And Forex is said to be little / no correlation to both Stock & Bond, thus it’s perfect for risk aversion.

- Besides, as explained later, Forex is Recession Proof Sector, means whatever & however the total economy changes, it doesn’t affect this market.

- Simply “Don’t put all your eggs in one basket” as an essential concept of Portfolio Diversification, and Forex must be a part of the asset class in your portfolio.

- You require huge liquidity that is a critical factor you often fail to take into account for the occasions requiring big money such as university funding or marriage for a dependent, and your own retirement etc. The liquidity refers to the accessibility of your asset, which can be measured as the time to arrive at your pocketbook if you happen to need it today. It usually relates to the size & participants in the market. See the first chart showing Forex Market Size from babypips which makes you realize how big the Forex market is. As seen, over $5.0 trillion average daily turnovers are over 12 times the average daily turnover of global equity markets. It means the liquidity of Forex is probably the best among all financial products.

So, yes, we consider Forex is a good source of Extra Income, namely residual income and we believe it should be a part of everybody’s asset portfolio.

Forex Market A Bit More

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies.  This market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the Credit market.

This market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the Credit market.

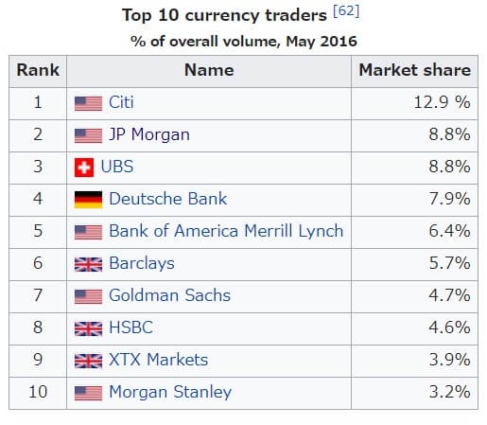

The main participants in this market are the larger international banks. Financial centres around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends.

Since currencies are always traded in pairs, the foreign exchange market does not set a currency’s absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: US$1 is worth X CAD, or CHF, or JPY, etc.

According to wikipedia; Foreign exchange marketAs it says Over The Counter (OTC), and it is mostly dealt with by banks, it’s also called “interbank” market.  The entire market is run electronically, within a network of banks, continuously over a 24-hour period, which means that the spot forex market is spread all over the globe with no central location. Trades can take place anywhere as long as you have an Internet connection.

The entire market is run electronically, within a network of banks, continuously over a 24-hour period, which means that the spot forex market is spread all over the globe with no central location. Trades can take place anywhere as long as you have an Internet connection.

Given the development of user-friendly trading platform and proliferation of on-line Forex brokers who offer the trading environments for individual traders, the trading volume of the individual traders namely Retail Traders has constantly been growing by well over 10% every year lately.

So, the infrastructure for retail traders has been all set.

Is Forex Trading Easy To Make Money?

So, is Forex Trading profitable? As said before, the spot trading accounts for over 90% of the total Forex market, it can be described as a Zero-Sum Game, means, for every winner, there should be a loser.

Let me share the hard fact that how many traders lose money in Forex Brokerage Accounts as below (for further details, check Passive Income Trading), then you will fully understand the reason why we say “Forex active trading without proper training is A Fool’s Errand“;

With the new European regulations that came into effect from August 1, 2018, brokers are required to display clearly on their marketing message what is the percentage of their clients that lose money. For example: “75% of retail investor accounts lose money when trading CFDs with this provider.”

Given the solid assumption that the winning rate of skilled traders & institutional traders is much higher than the inexperienced & retail traders, the losing % among inexperienced & retail traders is supposed to be much higher than 77%, probably close to the 95% which is often said in the industry.

Having said, unless you have enough commitments to the proper training, the best way to make money in Forex Trading is to make the best use of professionals’ expertise, which we define as Passive Forex Trading.

On top of the 3 reasons I listed before, there are many benefits of Forex trading such as;

- Low transaction cost

However, you also consider fundamental risks of;

- Enemy Broker / On-line Scams etc – for this particular topic of Enemy Broker, go to Select Trusted Forex Brokers With No Hidden Agenda for full details.

Safety Comes First

And, when it comes to Online Scams, allow me to remind you of the basic safety measurements before moving into 3 Forex passive tradings.

As said in my financial safety net related report, it’s widely believed that over 97% of on-line programs offering high-yield returns in the pooled fund are scams.

They disguise and tantalize you with easy profit which you should never consider as a lucky good income opportunity.

Therefore it’s better to stay away from any schemes you leave your money to other people’ entire control and focus on the schemes allowing you to make your money 100% under your own control.

3 Safe & Workable Passive Forex Trading

Three Safety Schemes to make Forex Trading Passive Income are;

- (1) Copy Trading

- (2) Managed Account / PAMM (Percentage Allocation Management Module)

- (3) Automated Trading by Forex Robot such as EA (Expert Advisor)

, which can provide you with Extra Income conveniently by Passive Forex Trading. I’ll elaborate on each passive income idea as follows;

(1) Copy Trading

Copy trading is a way to utilize the expert’s knowledge & skill in trading Forex based on the social trading platform. We discussed if copy trading is worth it in How Copy Trading Works 5 Facts.

You as an ordinary trader can automatically follow and copy one or more traders, which is basically100% passive income forex trading.

In copy trading, you can select individual traders to copy, whether by copying their individual trades or by copying their entire trading strategy. Therefore, you can assign a percentage of your account balance to follow a specific trader or several traders concurrently.

As long as you are copying a trader, every trade which they open will be replicated by a copy trade in your account.

You don’t need to participate in any Forex trading courses/study complicated strategies, but just need to choose the top trader in the social trading communities.

Social Trading Platform

In order to make it workable, we need a common platform called social trading network. It is the glue that connects all the traders and trade followers, similar to Facebook or Twitter.

There are 2 established platforms of eToro & ZuluTrade.

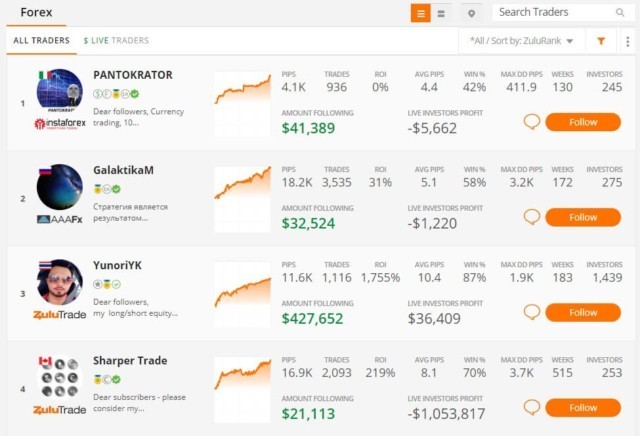

You can view & analyze the performance of real live traders (as shown below ZuluTrade traders)and you can automatically copy the trades in your account from the traders you decide to follow.

In fact, the social trading platforms initially focused on the idea-sharing between traders by creating a profile including trading strategies & performances to connect like-minded traders all over the world, which made the network provide the real-time trading feeds from the traders.

Because the networks share a transparent actual performance, it motivates the platforms to allow investors to automatically follow the trades from traders they believe to be profitable.

So, it is in a sense trading signal sent automatically from a selected professional trader, which are automatically copied and execute the exact same trading in your account.

Copy Trading Safety

It is not a Pooled Fund thus your money never leaves your FX broker account, there is no human intervention and no direct link between your account and the traders.

The professional trader you copy never touch your money but you do your own trading in your account which will be exactly the same trading of the professional you copy, therefore it’s a Ponzi Free safe system.

The security and privacy of your trading account are preserved. Your job is simply to find those profitable traders who are making good money on a consistent, long term basis – and copy them.

In Forex trading, only 5% of retail traders are said to make profits constantly. Needless to say, the selection of traders is a key success factor.

See eToro Review & ZuluTrade Review where you find the specific methods to choose the best traders.

Eventually, you can develop well-diversified traders’ portfolio to achieve stable growth.

The advantage of the copy trading in comparison to the PAMM in the next section is a cost. You basically don’t pay anything to the trader in the copy trading because they are compensated by the social trading companies that provide the platform.

(2) Forex Managed Account – PAMM Investment

Forex Managed Account is the alternative investment a money manager trades the foreign exchange market on a client’s behalf for a fee.

Managed Trading Account contains a portfolio of securities that is owned by an individual investor means you yourself directly own but are chosen and traded by a hired professional money manager on your behalf (100% Passive Income) – trading can be managed by human namely discretionary trading or automated technique such as using a robot that can eliminate emotion.

Generally speaking, for minimum investment, most brokers will need at least $100k and more to agree to work only for you., which is a big entry barrier for the normal investor, then the new technology called PAMM – Percentage Allocation Management Module will help you.

Theoretically, the module can accept from a cent, and in fact, some PAMM trader permits the investment from $1.

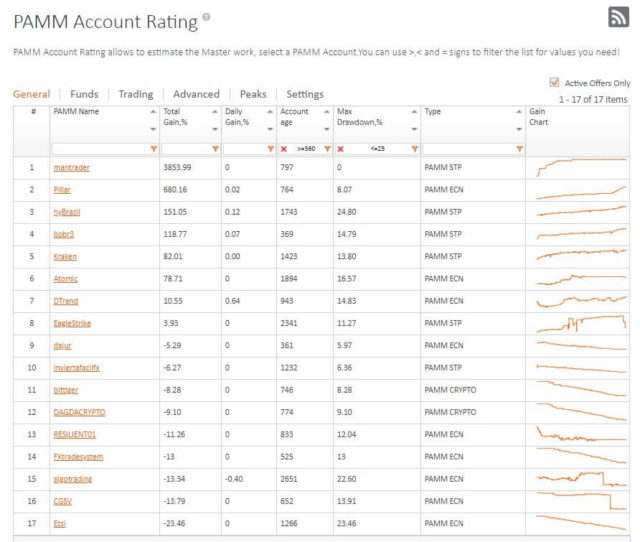

PAMM Broker

PAMM account is provided by Forex brokers.

There are few other software featuring more or less the same function as PAMM, which are LAMM (Lot Allocation Management Module) & MAM (Multi-Account Manager).

Your account is just electronically connected to the trader’s master account by the above software, means that every time a trade is taken you get a duplicated order electronically into your account.

Currently, FXOpen is said to be one of the best PAMM brokers.

Regarding how to select the best PAMM manager, please check PAMM Investment Ultimate Guide – 7 Secrets To Find The Best Account.

PAMM Safety

In Managed account, any of your money never leaves from your hand but all are kept in your brokerage account under your own name.

You grant permission to the experienced traders to access to your account in the LPOA (Limited Power Of Attorney) contract so as to trade on your behalf.

The traders cannot steal your money, as it is fire-walled by the brokerage house to prevent this from ever happening.

BTW, PAMM structure itself is a scam free but it doesn’t mean your fund is safe if the broker itself is not honest – see Alpari Caution section in Best PAMM Accounts Honest Opinion.

The bottom line is that the PAAM allows small investors to enjoy the security & return of the managed account.

Note that the investors should open their accounts in the same brokerage where the trader manages to use PAMM. Means usually you can’t choose your own broker by asking the trader to use it for managing your account.

Anyhow, under PAMM, you don’t need to learn how to trade Forex or any Forex trading strategies but need to select the best money manager who trades Forex for you, means it’s a 100% passive income.

(3) Forex Robot

A Forex robot is a piece of software that analyses the market based on settings entered by the user. In other words, the user does not need to make any trading decisions.

Essentially it is referred to as a robot because it mimics all of your actions, only it takes mistakes that are inherent to human emotion out of the picture.

Profitable Forex traders usually buy and sell currencies throughout the day (similar to day traders with stocks). Therefore, a Forex trading robot can be extremely valuable because the software will manage all your trades in every way from start to finish.

A Forex robot makes automated trades that can be carried out even as you sleep.

Forex trading robots usually allow Forex traders to input the currencies they would like to trade, their long-term trading goals, prices at which to trade, and so on.

For investors whose profit margins can change in the blink of an eye, being able to immediately capitalize on price changes is extremely vital. The program is automated so as to recognize potential for profit, then automatically buy or sell.

Forex robots make all of their trades based solely on the numbers. Their algorithms look at a wide variety of daily, semi-daily, and long term trends. A Forex robot makes a trade based on what is most likely to achieve a profitable end result.

When it loses a little it doesn’t panic and end up flushing away even more cash; when it wins big it doesn’t waste the winnings on the emotion of excitement, thinking that it can win again and again today only to end up losing it all.

The industry-leading Forex trading platform is MetaTrader. Because of its versatility and simplicity of use. Most Forex brokers across the world offer MT-4 as a trading platform for its customers.

A robot is written in MetaQuotes Language 4 (MQL 4), the built-in programming language of MT-4. Therefore, the most common type of Forex robot is designed for the Metatrader, and is often referred to as a “Forex Expert Advisor”, “Forex EA”, or just “EA”, or simply “bots”.

Metatrader expert advisors can take control of your trading account and make trades according to whatever parameters you set.

Forex robot eliminates the major weakness which holds traders back from becoming successful, i.e., human emotions, see Why Most Traders Lose Money – 24 Surprising Statistics.

As any seasoned trader will tell you, the frail human emotions of fear and greed are a trader’s arch-enemy and the cause of most traders’ failure.

People tend to ‘feel’ when they are speculating upcoming changes rather than study charts, look at trends, and base their trades on solid numbers. People also tend to react to large loses, and even gains, by making Forex trades that they would normally never even consider.

This is where Forex robots step in to provide a solution, simply removing the psychological element of trading, which can be detrimental.

It is important to note that there is no such thing as the “holy grail” of trading systems, whether automated or not. There are profitable Forex robots out there. The problem is that it takes testing over a reasonable period of time to figure out how profitable they are.

Most of the companies and individuals that sell these robots are great about writing sensational claims, but the customers soon find out that many Forex robots are not as claimed.

Therefore, as explained in the managed account chapter, the most important element is to chose the reliable robot, for this particular point, please read 5 Easy Steps To Find The Best FX Robot (EA).

BTW, a few of the best auto trading robots are;

Forex Robotron

Forex Robotron has the dynamic profit feature which closes a trade as soon as it goes into a loss and the dynamic profit features, on the other hand, will ensure the robot exits at the best possible time.

The results show a low risk with tight stop loss and great consistency. See the 3rd party verified results in myFXbook;

The Real-Time Trading Update is;

Happy EA

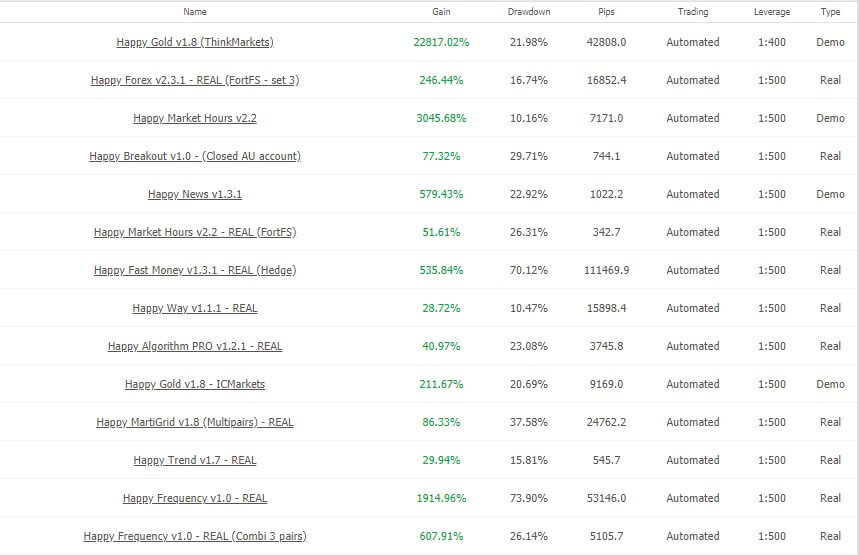

Happy Forexproduces a wide range of EAs as shown in myfxbook below and they bundle 10 EAs and sell in full-pack. When you use Market Grid version, although the result shows very consistent, bear it in mind that Martingale strategy is a high-risk approach which can possibly blow your account overnight.

Currently, they run a 30% price off the campaign. The 3rd party verified results is publicized in myFXbook;

The Real-Time Trading Update is;

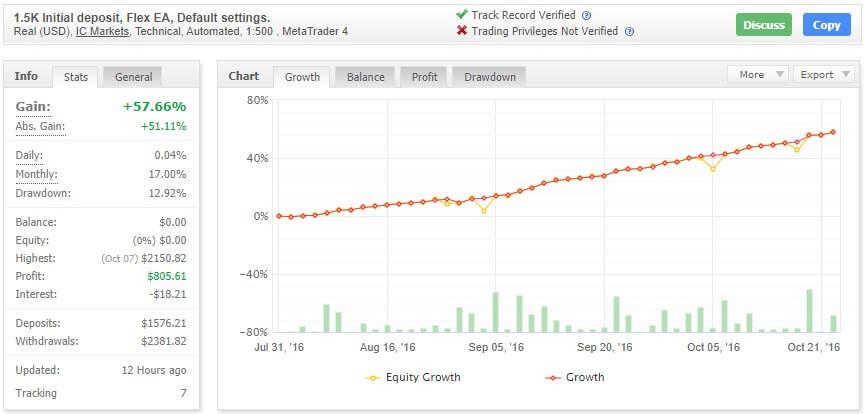

Flex EA

Flex EA is a highly rated EA including an automatic update system that consistently provides profit without regularly updating the settings. In its active exclusive Forum, you can check the other members’ experience of this EA and exchange the opinions.

Currently, they run a huge discount of 67% off, use the code ‘FLEX67OFF’ at check-out. See the 3rd party verified results publicized in myFXbook;

The Real-Time Trading Update is;

For the full list, go Most Profitable Forex EAs & Forex Signals List.

Three Passive Forex Trading Summary

Quick Comparison Among 3 Passive Income Through Forex

- Cost: Social Copy Trading and Robot have a cost advantage over a managed account. Managed account trader commonly charge over 30% commission against profit (PAMM is usually much lower depending on each broker & money manager). As briefly explained before, you don’t pay any fee to the trader you copy in the social trading platform and most robots cost you only a one-time expense that is average a few hundred $.

- Security: Obviously, Robot is the highest because you don’t involve any other human being that could harm you but just install the software within your own trading system. Copy Trading & PAMM are more or less the same though you may feel PAMM is less safe because, with Copy Trading, no other persons except you trade your account. For this particular point, it’s more related to the next “Degree Of Control”.

- Degree Of Control: PAMM is very limited. Your funds are allocated to the money manager for a set period of time and you accept the results at the end of this period. It’s absolutely hands-off. However, copy trading offers much higher control to you, because as said, your fund never leaves to anybody else. Needless to say, EA is 100% under your control.

Passive Forex Trading Income Conclusion

Allow me to repeat, trading Forex and making money from it is a hard task. Being a good trader requires a lot of study and work by doing homework on the markets every day, watching the markets for an opportunity and carefully entering into a trade.

This arduous process is repeated for every trade, day after day. It is a lot of work and is very stressful. So, it takes a lot of practice  and analytical thinking to become a successful trader and what if a collection of such analytical thinker made all your trading decision – this is the core concept behind the 3 Forex Passive Income here, using experts’ expertise regardless of human or robots.

and analytical thinking to become a successful trader and what if a collection of such analytical thinker made all your trading decision – this is the core concept behind the 3 Forex Passive Income here, using experts’ expertise regardless of human or robots.

Finally, you may decide if this Passive Forex Trading is the right way for you by considering the balance between the fees & commissions and your free time based on your goals in trading Forex.

Once you decide to pursue any of the 3 passive Forex tradings, suggest you conduct sufficient due diligence to select the right expert so that you will achieve solid residual income forex on the side.

Hope these will help to add a new way of achieving steady extra income.

Good Luck!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

BTW, we GEM deal with 6 Advantage Play as follows;

For Full Index of Our Guides, Go; List Of Special Reports – All Information are Based On Our Intensive Research & Professional Analysis

(Absolutely 0 Risk) Matched Betting

(Absolutely 0 Risk) Matched Betting (0 – Marginal Risk) Casino Bonus Hunt

(0 – Marginal Risk) Casino Bonus Hunt (0 – Marginal Risk) Bingo Bonus Hunt

(0 – Marginal Risk) Bingo Bonus Hunt (Absolutely 0 Risk) Spread Betting Bonus

(Absolutely 0 Risk) Spread Betting Bonus (Absolutely 0 Risk) Sports Arbitrage

(Absolutely 0 Risk) Sports Arbitrage (Reasonable Risk) Tipster Value Bet

(Reasonable Risk) Tipster Value Bet

Comment

Good day! This is mmy first comment here so I just wanted to give a quick shout out and say I truly enjoy reading through your articles. Can you suggest any oter blogs/websites/forums that go over the same topics? Thanks a ton!

Good day! This is my first comment here so I just wanted to give a quick shout out and say I truly enjoy reading through your articles.

Heya i’m for the first time here. I came across this board and I in finding It truly useful; it helped me out a lot. I hope to give something again and aid others such as you aided me.

I just could not go away your website prior to suggesting that I actually enjoyed the standard info a person provide in your visitors? Is gonna be again ceaselessly in order to check out new posts

Spot on with this write-up, I really believe this amazing site needs a great deal more attention. I’ll probably be back again to read through more, thanks for the info!

Having read this I believed it was extremely enlightening. I appreciate you taking the time and effort to put this informative article together. I once again find myself personally spending way too much time both reading and leaving comments.

But so what, it was still worth it!

Hi my loved one! I wish to say that this post is amazing, great written and come with approximately all vital infos. I would like to peer extra posts like this .

I like the valuable information you provide for your articles. I’ll bookmark your weblog and check once more right here regularly. I am slightly certain I’ll learn lots of new stuff proper right here! Good luck for the next!

Hi there, just became aware of your blog through Google, and found that it’s truly informative. I am gonna watch out for brussels.

I’ll appreciate if you continue this in future. Many people will be benefited from your writing.

What’s up, I read your new stuff daily. Your humoristic style is awesome, keep it up!

It’s a shame you don’t have a donate button! I’d without a doubt donate to this excellent blog! I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to brand new updates and will talk about this site with my Facebook group. Chat soon!

I’m gone to tell my little brother, that he should also pay a visit this webpage on regular basis to obtain updated from latest reports.

Yes! Finally something about RELEASES EMPRESARIAIS.

Having read this I believed it was rather informative. I appreciate you finding the time and effort to put this information together. I once again find myself spending a significant amount of time both reading and commenting. But so what, it was still worthwhile!

It’s an amazing post designed for all the internet visitors; they will take advantage from it I am sure.

I like it when people come together and share views. Great blog, keep it up!

This paragraph is genuinely a nice one it helps new internet visitors, who are wishing for blogging.

I like the valuable info you supply on your articles. I will bookmark your weblog and test once more right here regularly. I’m relatively certain I’ll learn plenty of new stuff right right here! Best of luck for the next!

Hello my loved one! I want to say that this article is amazing, nice written and come with almost all important infos. I would like to see more posts like this .

Everything is very open with a clear description of the issues. It was definitely informative. Your site is very helpful. Thank you for sharing!

Greate article. Keep writing such kind of info on your blog. Im really impressed by it. Hi there, You’ve done a fantastic job. I will certainly digg it and personally recommend to my friends. I’m sure they will be benefited from this web site.

You need to be a part of a contest for one of the greatest websites on the net.

I will recommend this blog!

I couldn’t resist commenting. Very well written!

Hi there to all, it’s actually a fastidious for me to pay a quick visit this web site,

it contains helpful Information.

Admiring the dedication you put into your website and in depth information you offer.

It’s awesome to come across a blog every once in a while that isn’t the same outdated rehashed information.

Wonderful read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

Thanks for sharing your info. I really appreciate your efforts and

I am waiting for your next post thank you once again.

Pretty nice post. I just stumbled upon your weblog and wished to say that I’ve truly enjoyed surfing around

your blog posts. After all I will be subscribing to your rss feed and I hope you

write again very soon!

It’s going to be finish of mine day, except before

ending I am reading this wonderful paragraph to increase my

experience.

It’s an amazing piece of writing for all the

online users; they will take benefit from

it I am sure.