Is eToro Legitimate and Safe?

eToro is a social trading and multi-asset brokerage company and regarded as pretty safe based on the elements of “Legitimacy”, “Security”, “Financial Soundness” & “Trading Transparency”.

This guide is actually an eToro full review including how to locate the best trader to copy, and firstly, let me quickly verify each element of safety;

Legitimacy – License

eToro is a Cypriot Investment Firm (CIF) and regulated by;

- the Cyprus Securities and Exchange Commission (CySEC) in Europe – eToro CySEC Status

- the Financial Conduct Authority (FCA) in the UK – eToro FCA Status

- the Australian Securities and Investments Commission (ASIC) in Australia – eToro ASIC Status

- in the USA, the license has been gradually rolled out by state since 2018 – eToro USA status

Security

Since eToro operates in accordance with FCA, CySEC and ASIC regulations, meaning that there are measures in place to protect investors money, namely eToro clients’ funds are segregated (as required by FCA) & kept secure in top-tier banks.

All of the clients’ personal information is guarded under SSL encryption.

eToro offers an option to activate Two Factor Authentication (“2FA”) in the client’s account which requires you to enter a verification code sent to your mobile phone via SMS in order to access your account.

Financial Soundness

Let me briefly share the history of eToro.

eToro was founded by the brother’s Yoni Assia & Ronen Assia together with David Ring in 2007 in Tel-Aviv, Israel (eToro “About”). They started as a simple online Forex broker but expanded its product offering by introducing a professional trader’s application Expert Mode and a web-based trading platform WebTrader in 2008.

The Open Book social investment network was launched in July 2010, with the “Copy Trader” feature released in May 2011. The Copy Trader enables users to view, follow and copy the network’s top traders in real-time (watch eToro Copy Trader Video), as such allows you to create a so-called people-based portfolio.

Thanks to the $223 million funding in total, it expanded the business smoothly establishing research and development office in Israel and additional offices in UK, Cyprus, the US, Australia & USA and currently have over 11 million users in over 140 countries.

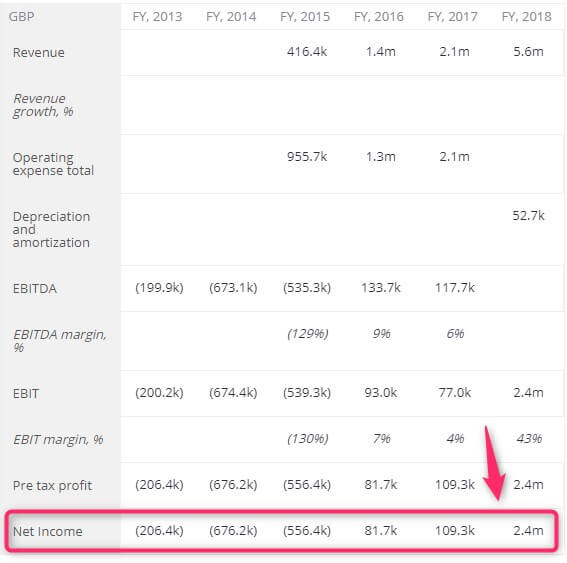

According to Craft, eToro generated $2.4 Mio net income in 2018 with steady year by year improvements as seen from the below income statement;

eToro looks financially healthy.

Trading Transparency

When it comes to financial brokerage, certain MM (Market Maker) broker manipulate the trading which could end-up with your disadvantage.

Because in MM broker, you are not competing with the market but competing with the broker thus a conflict of interests between you & the broker (see full details in Select Trusted Forex Brokers With No Hidden Agenda).

However, as seen from the eToro brokerage profile, eToro is an STP (Straight-Through-Processing) platform with NDA (No Dealing Desk) model. This means they have no room to trick your trading such as changing the price at their end and you feel safe by being connected to the real market.

So, with all these facts, eToro is obviously not a scam but legit and safe.

Is eToro Good?

However, safety doesn’t answer the question of “Is eToro good?”. eToro is considered to be good for beginners and enable you to make a decent profit as long as selecting the right traders to copy.

Is eToro Good for Beginners?

This is a popular question about eToro. eToro is a Social Trading Platform that allows you to copy other experienced traders’ trading to profit conveniently. Means, yes basically you don’t even require any trading experiences to start copy trading.

eToro has become the market leader in the Social Trading industry and the arch-rival is ZuluTrade (see our ZuluTrade Ultimate Guide).

BTW, many people seem to discuss eToro vs Plus500 though, Plus500 is just a CFD (Contracts for Difference) & Forex broker and they don’t provide any social trading or copy trading platform. So, don’t get confused.

Can You Make Money with eToro?

This is another popular question. 75% of retail eToro investor accounts lose money when trading CFDs.

Therefore, you need to be careful with your own trading. Copy trading is proven to improve your performance based on the below MIT research project, but needless to say, you need to select the right trader you follow & copy (see the section of How to Find the Best Trader to Copy).

MIT & eToro have done joint research. MIT Professor Alex “Sandy” Pentland explains it in the interview by Deloitte.

The traders who had the right balance and diversity of ideas in their network—meaning that their social learning was neither too sparse nor too dense—had a return on investment that was 30% higher than the returns of both the isolated traders and those in the herd.

” HBR (Harvard Business Review), which includes the below video;

See Appendix 2 at the bottom for further details;

eToro Strength & Weakness

So, the below shows the summary of eToro pros & cons including eToro cost;

Strength

☑ Simple & Easy Use of Interface: The information made available in the Trading & Investing Platform is kept basic, making it easy for newbies to use. There are a few simple tools to help you find the Traders or Professional Investors you want to follow and copy – see Trade Like Steve.

☑ Convenience: Because eToro operates both a social investment network and broker, you can manage everything through the same interface (no need to sign up with a different broker).

☑ Low Slippage: Thanks to the above integration between social trading network and broker, in most cases (>90%), automatic copy trading from other traders results in no slippage except very few occasions of only be about 1 pip difference for Forex trades. Hence unlike with some other social trading networks, slippage isn’t really an issue.

☑ Quality Tools for Copy Trading: One innovative instrument is CopyPortfolios, where you can copy trade from eToro to a single fund. CopyPortfolios can also be used by self-directed traders to diversify their own business. Other characteristics like the Editors ‘ Choice and Popular Investor serve as extra ways eToro tries to discover you the best traders to copy and/or follow.

☑ Expert Trader Verification: Traders should display real name/photo in profile (verified by eToro), which adds some level of trust that you’re following real people.

☑ Free & Fully Functional Demo Account: eToro allows you to trade with a fully functioning demo account free. You can follow Traders using virtual money to evaluate and review their performance in $ gain terms. This will give you a more realistic view of what you can expect when you finally allocate the real money.

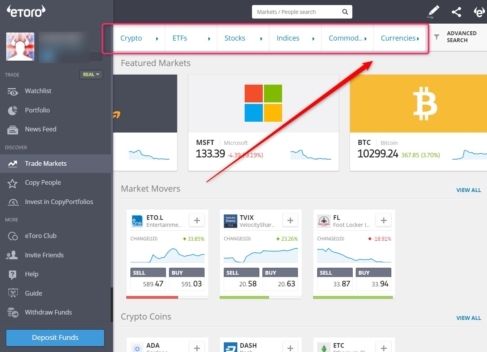

☑ Wide Trading Choices: In addition to Forex Trading, you can also trade on major indices, commodities (oil, gold and silver) via CFD, and an impressive range of Crypto as below;

☑ 0% Commission US Stock: You can trade stocks without paying any commissions to eToro, see here for details.

Weakness

☠ Limited Information of Traders: Given the focus on novice investors, you’re unable to view the full history of all trading details of each trader, the calculation is confusing and lack of transparency. Thus very large % gain numbers may set some wrong expectations.

☠ Deviation: Actual results in your account will often not totally match the ones displayed for the trader you copy in the eToro interface, mainly because they often use their commission payments to add to their balance at the end of each month, which could be included in return calculation.

☠ High Spread: The eToro spreads on each trade are arguably slightly higher than most brokers (e.g. 3 pips for EURUSD).

☠ eToro Fee (Rollover Fee): The overnight rollover fees (for any trades positions left open overnight and over the weekend) charged by eToro are also a bit higher than most brokers. You need to watch this closely since most of the traders have a tendency to keep positions open for weeks or months, meaning over time these rollover fees will add up if open trades aren’t managed carefully.

However, they comment regarding eToro fees are;

- List items eToro emerged 10x cheaper than its nearest peers.

- 20X cheaper than traditional brokers.

- 10X cheaper than fintech brokers.

eToro Practice Account (Demo Account)

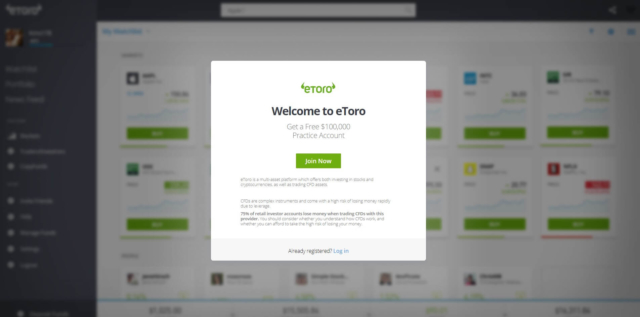

You may wonder how eToro actually works and is worth it for you. The best way is to experience without investing your single money.

eToro Demo Account Benefits & Process

The eToro demo account, the so-called eToro Practice Account allows you to make unlimited access free and use $ 100,000 virtual money to try out copy trading or any other tradings available in the eToro platform.

Remember, you will have all the same features as their ‘real-money accounts (including the CopyTrader functionality) in a practice account.

1. Open Free Account

Go free practice account No brainer, just fill in your “Name”, “User Name”, “Password”, “e-mail address” & “Phone Number”;

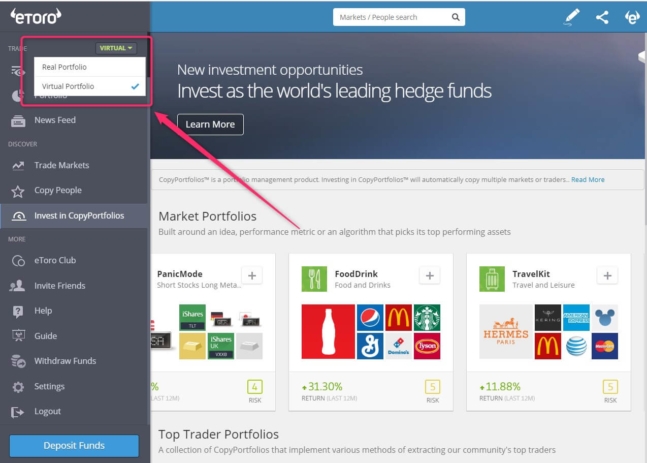

2. Switch to Virtual Account

Once you verify your email account and log-in to your account for the first time, you are in the Real Trading account with the balance showing 0. In order to use Practice Account, select Virtual Portfolio at the left top box as below;

By confirming your virtual account switch, you are finally in the practice account with the balance of $100,000 virtual money.

3. Start Trading Free

Now, you are in the position to try out eToro main features of;

- A) Select CopyPortofolios: Invest in a diversified eToro CopyPortfolios

- B) Copy Other Traders By Yourself: Access the eToro community to select traders you want to copy & develop your own copy portfolio

- C) Trade Markets: Access to market section to trade by yourself

In this guide, we focus on A) & B).

4. Tips for Risk Management Setting

You will find the specific instruction on how to start Copy Portfolio or how to find the best traders in the next section. Let me give you a few tips regarding the risk management settings.

Firstly, although you’re using virtual money suggest you consider it as a real account to seriously assess your future potential profit or loss. Remember, the virtual account performs exactly the same as a real account, thus simulate what you plan to do with real money in future, so if you intend to invest only $500 then set $500 in a demo account rather than $1,000.

Thus, for a risk-management setting, I personally believe it should be conservative. People tend to be attracted by the amazing growth.

If you expect to double your account in 1 month, then you have to accept the risk of losing all your equity in that period as well. Be moderate & sustainable.

The good thing of eToro regarding risk management is its automatic risk setting as;

- you can assign a maximum of 20% of your equity to 1 Guru

- you can copy a maximum of 20 Gurus in your account

You can control the Stop Loss for the trades you copy, so make the best use of its function by realizing your risk tolerance. You may want to see the Asset Management article related to eToro that also discuss risk tolerance.

How To Find The Best Trader To Copy

Copy Trading Overview

First, watch the video which explains most of all you need to know for starting up;

In comparison with ZuluTrade, the Popular Investors data is unfortunately limited, especially for the maximum trading period accessible is 3 years.

However, unlike ZuluTrade Signal Provider who can use a demo account, eToro Traders need to trade their own real money and the fact that their commission is paid based on the consistency of their performance rather than simple profitable trading, which can obviously enhance the credibility of Popular Traders.

Yet, all in all, given the lack of advanced filters like ZuluTrade and the little transparency of the return %, the best search seems to be finding relatively better Popular Traders and not use any return expectation based on the available statistics.

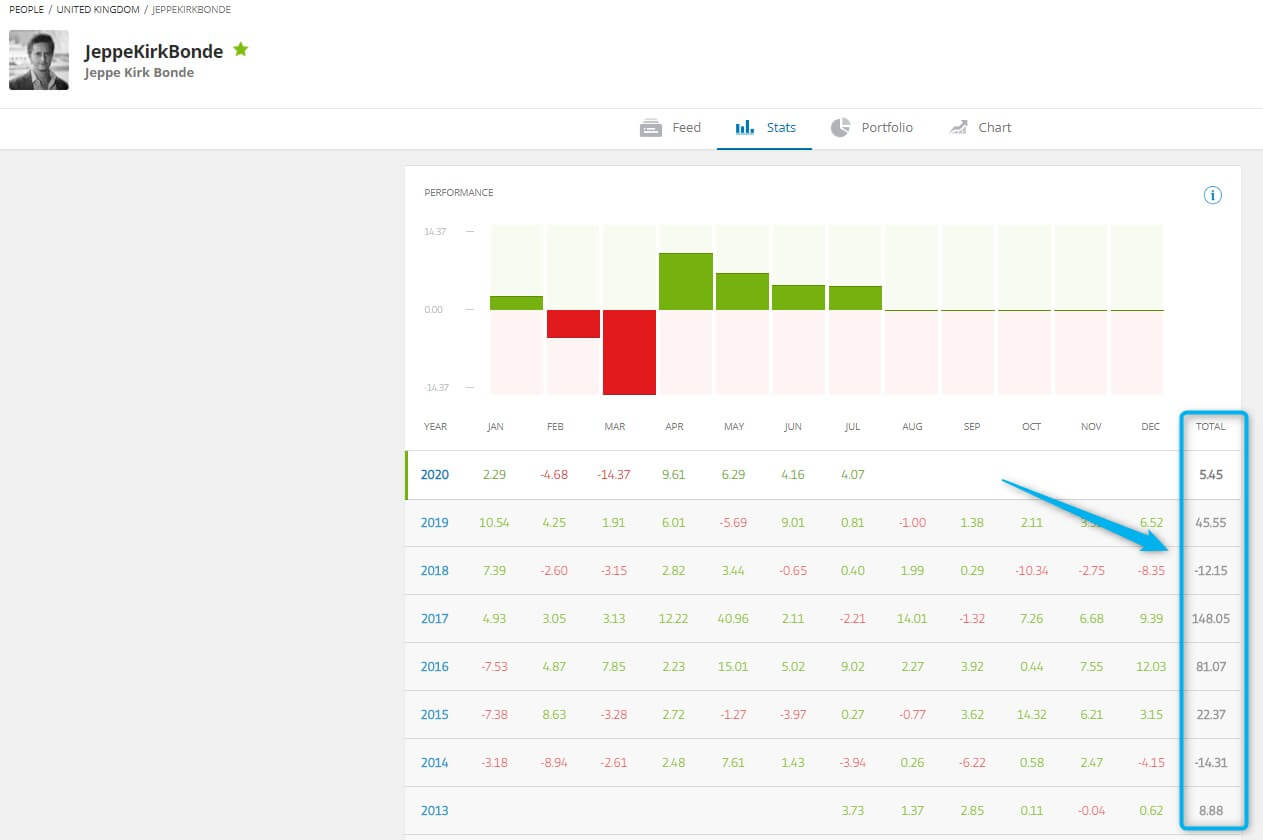

Many people search for the best trader with keywords of etoro copy trade Reddit / etoro review Reddit where JepperKirkBonde posts his strategy.

Although his performance is a bit bumpy, overall performed quite well as below;

So, can you make money on etoro Reddit? Possible, the important thing is to never blindly jump on the pitches but carefully follow the instruction below;

We share 2 different approaches of “Invest in Copyportfolios” and “Develop Your Own Portfolio”

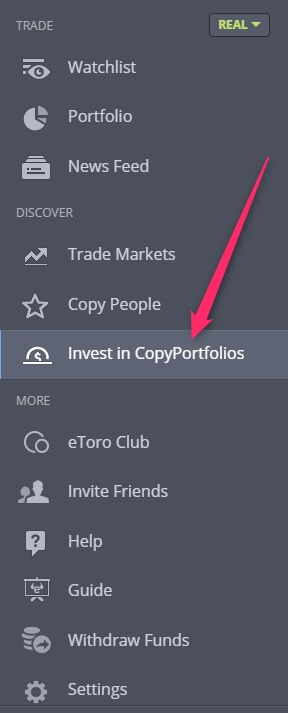

(1) Invest in Copyportfolios

For those who are new to trading/copy trading, investing in Copyportfolios is the ideal approach. This is similar to ZuluTrade Combos.

The investment committee of eToro manages your assets professionally and the performance of each CopyPortfolio is analyzed in-depth and automatically rebalanced to maximize its capacity for profit.

You click Invest in CopyPortfolios in the sidebar as below:

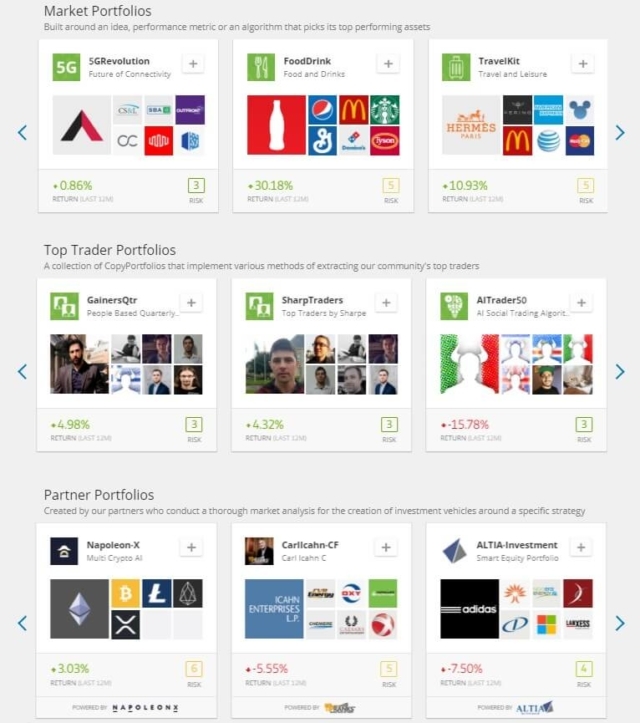

You can invest in 3 kinds of CopyPortfolios:

- Top Trader Portfolios: Comprise eToro’s best-performing and most viable traders

- Market Portfolios: Bundle CFD shares, commodities or ETFs together under one selected market approach.

- Partner Portfolio:

Choose the appropriate CopyPortfolio for your strategy. Enter the amount you would like to spend. Click the “Invest” button and your portfolio is now fully assigned.

This approach is by far the most convenient & possibly safest for any newbies. Watch the below video;

(2) Develop Your Own Portfolio – 4 Specific Process

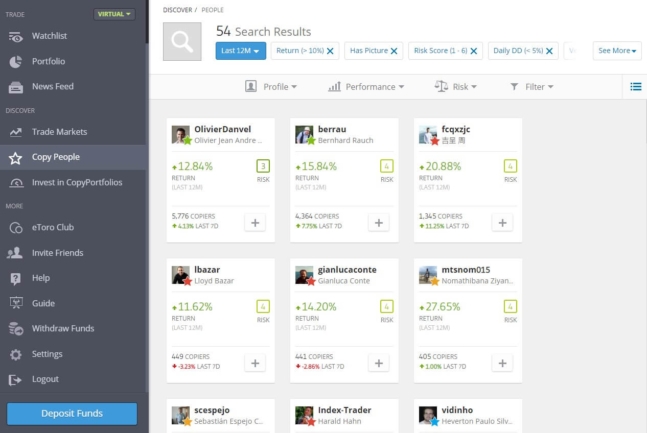

To search the trader you want to copy, choose “Copy People” “Editor’s Choice” and filter what you want to see. One of the most important criteria you need to check is Past Performance as long as possible.

Never set short-term such as a past month or past 3 months. At least 1 year, very minimum (eToro’s limitation is only going back to 2 previous years).

1) Initial Filter

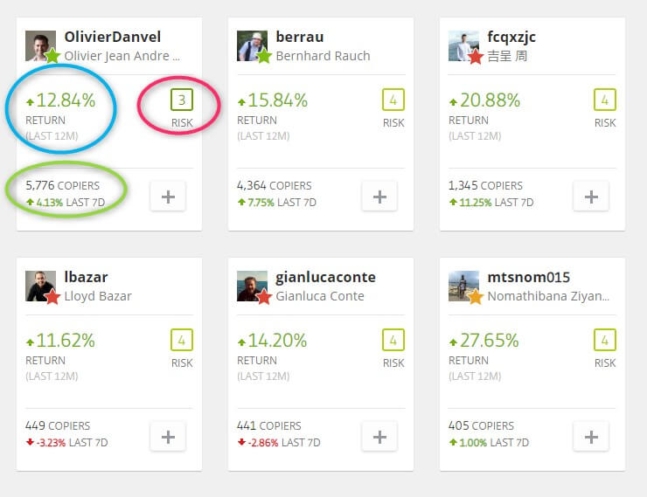

I just set people from everywhere, who invest in Forex, and gained at least 10% during the last 12 months and didn’t lose more than 5% in any week during this period. Then, the result shows;

You may want to see the trader with a low-risk approach (up to 3-4), modest return(up to 15%) and a good number of followers (over 1,000), then, Olivier is an interesting candidate;

2) Past Performance – Stability

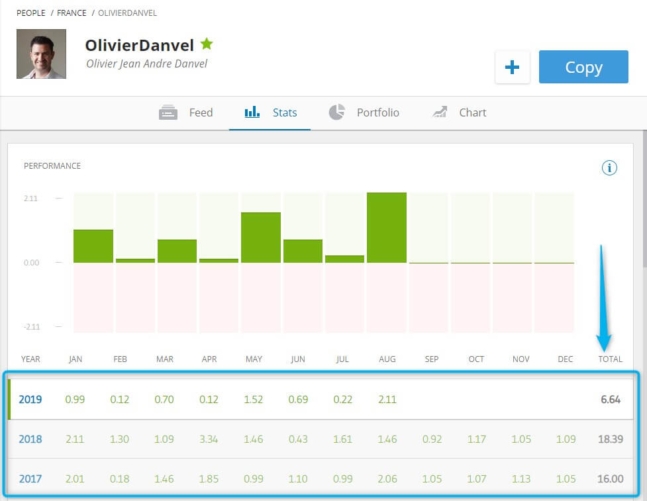

Go to the detailed profile & trading performance of the selected Trader

Stability is very important. The stat automatically shows the past 3 years (including this year) performance. Olivier is absolutely stable, no single negative month;

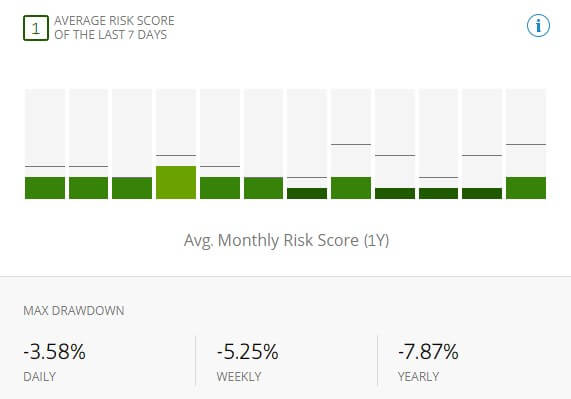

3) Risk Management – Max Draw Down

Given the above stable performance, his risk-management must be excellent, and yes it is proven by the number as;

In case, you want to check the trader’s ability further, you may also want to go through PAMM Investment Ultimate Guide – 7 Secrets To Find The Best Account.

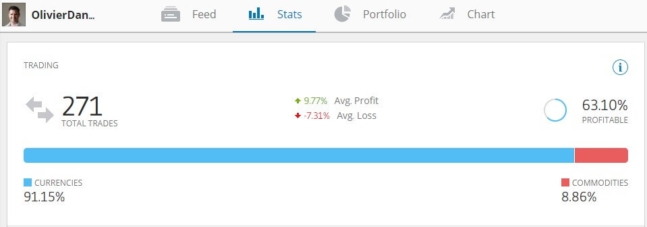

4) Trader’s Portfolio – Own Trading Ratio

You need to check if the trader’s portfolio is driven by his own trading. If the majority of the trader’s portfolio comes from the copies of other traders, then it doesn’t reflect the trader’s own trading ability.

Well, we can say creating a good portfolio is also a good ability, in this case, suggest you check the next 5) Copy Fund.

Anyhow it’s better to confirm how the trader makes money. Olivier’s portfolio comes from 100% own trading;

eToro 0% Commission

Expanded Areas

eToro said;

Following its tremendous success in Europe, eToro’s 0% commission stocks offer is now available in Australia, GCC, Latin America and Southeast Asia.

What is eToro Stock 0% Commission?

In the first place, what’s the eToro Zero Commission? You usually need to pay a high commission to your stock brokers when you buy stocks.

However, eToro enables you to trade a wide selection of US stocks with no commission, removing a significant entry barrier. 0% commission applies to all non-leveraged, long (BUY) positions on US stocks.

This benefit applies to stocks traded on the NASDAQ and NYSE. All other stocks are traded as CFDs and bear commission.

eToro 0 Commission Snapshot

- 0% commission on real stocks and ETFs

- No UK stamp duty to pay

- Buy fractional shares

- Own the underlying asset

- Receive dividends

- Low minimum trade of $50

- Available to clients within the UK, all EU, Australia, GCC, Latin America and Southeast Asia

- 0% commission does not apply to US residents

Create a Free Account or See further details;

Note;

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees may apply. Your capital is at risk. For clients of eToro AUS Capital Pty Ltd. AFSL 491139, only stocks traded on US stock exchanges are available to trade with no commission. Other stocks are offered as derivatives and bear commission. Offered through ARSN 637 489 466 and promoted by eToro Australia Pty Ltd. CAR 001281634. For additional information, click here.

eToro Wrap Up

In short, eToro offers good opportunities for every trader including newbies to make a decent profit passively. However, never ever be greedy.

Empirically, the successful investor aims at sustainable & conservative growth with low risk. Just selecting the most popular traders does not seem to achieve that objective.

You need to develop a well-organized Portfolio to diversify the risk, keep monitoring the progress and re-evaluate your allocations periodically.

By doing so, you will expect steady extra passive income from it and it’s really worth trying.

Why Do We Use eToro To Earn Extra Money?

Lastly, allow us to share a bit about our trading principle. Our site intends to provide you with smart ways to Make Extra Income. As a part of it, we consider Passive Income By Trading. Why? Because the newbie traders generate extremely high loss rate – see the harsh reality in numbers.

Thus, we use 3 passive trading methods as the most practical & safest ways to succeed in Forex Trading & some other Financial Tradings. eToro is a leader of the Copy Trading (Social Trading) industry, which is one of our 3 methods.

Unlike some of the advantage plays that guarantee profits based on the mathematical edge, eToro social trading is neither risk-free nor guaranteed profits. However, copying the experienced experts’ trading automatically in the eToro platform; will substantially improve your profits because professional/institutional traders’ average winning rate is significantly higher than retail / individual traders.

will substantially improve your profits because professional/institutional traders’ average winning rate is significantly higher than retail / individual traders.

Opening up an eToro account doesn’t cost you anything and eToro Fees to copy experts’ trading are free, so go through our guide and consider trying it, suggest with free practice account without using your own money first.

If you’re already registered but not started seriously, go eToro login and search best traders by following the several options explained later in this article, you may also see etoro review Reddit where you can find the post by the most copied popular investor.

Alternative Passive & Own Trading

Alternative Passive Tradings

eToro belongs to Social & Copy trading that is the 1st of 3 Passive Trading, the others are;

If you’re sceptical about trading Forex PASSIVELY, then suggest you first read the below report; 【 3 Practical & Safe Ways To Succeed In Passive Forex Trading 】, which gives you a good insight into how it works.

Forex Own Trading

For those who still would like to pursue self-trading, strongly suggest you go through:

These reports comprehensively explain how you can evolve Forex Trading successfully by using world top-class tools & the full list of them.

It includes the introduction of Trading For A Living: Lucrative Trading Business, Travel the World And Work For Less Than 20h/week.

Appendix

eToro Broker Account Features

Let me summarize a few technical facts of eToro Web Trader for you to make a brief look at its broker function as follows;

- Broker Type: Market Maker (No Dealing Desk) (STP)

- Traders From USA: Yes / Islamic Account: Yes / Free Demo Account: Yes

- Trading Platforms & Tools: Web-based Own Proprietary Platforms (both PC & Mobile) / CopyPortfolios

- Account Currencies: USD / EUR / GBP

- Minimum Deposit: $200 / Minimum lot size: 0.1 lot / Minimum Trade Size: 10000

- Leverage: Maximum 400:1

- Spreads (pips): EUR/USD3, GBP/USD4, USD/JPY2

- Payment options: Credit & debit cards, Neteller, PayPal, Skrill, Wiretransfer etc.

- Fee & Commissions: Margin Interest:No / Depositing Fees:No / Withdrawal Fees:$25

- Scalping: No / Hedging: Yes

- Free Demo Account: Yes (up to $10,000)

- Trading Detail Tools: Stop Order:Yes / Limit Order:Yes / Market Order:Yes / Trailing Stop Order:Yes / OCO Orders:Yes / One Click Trading:Yes / 24hr Trading:Yes / Charting Package:Yes / Trade-off Charts:Yes / Streaming News Feed:Yes / Email Alerts:Yes / Mobile Alerts:Yes / Telephone Orders:Yes Personal Account Manager: Yes

- Supported Languages: Arabic, English, French, German, Italian, Russian, Spanish

- Customer Service: by Newsletter, Call Back, Phone, Chat, Email

- Customer Service Hours: 24/5

Good Luck!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment