What’s Passive Income Trading?

Passive income trading, in our definition, is making the best use of experts’ ability (both human & machine) to generate regular profits from financial trading with minimum efforts to maintain it rather than executing every trade by yourself, namely active trading.

Financial trading can be Forex, Cryptocurrency, Equity (stocks), Bond, CFD, and Commodities, etc though we mainly focus on Forex trading in this guide.

We say Use Experts’ Ability, and we have the following 3 specific methods to do passive income trading;

- Copy Trading (Forex / Stock / Commodity): Copy trading enables you to automatically copy the trades in your account from the traders you decide to follow via the social trading platform, with virtually No Cost. eToro & ZuluTrade are said to be the most established platforms (see our eToro full review

eToro full review; / – This guide is actually an eToro full review including how to locate the best trader to copy, and firstly, let me quickly verify each element of safety;

eToro full review; / – This guide is actually an eToro full review including how to locate the best trader to copy, and firstly, let me quickly verify each element of safety;

& Zulutrade full review). Zulutrade full review; / – ZuluTrade Demo Account allows you to access permanently and you can create up to 10 such free demo accounts under the same email!! You can diversify your assets by following multiple traders, which forms a new type of portfolio a.k.a. People-Based Portfolios.

Zulutrade full review; / – ZuluTrade Demo Account allows you to access permanently and you can create up to 10 such free demo accounts under the same email!! You can diversify your assets by following multiple traders, which forms a new type of portfolio a.k.a. People-Based Portfolios. - PAMM (Forex): Percentage Allocation Management Module is a technological solution in the Managed Account. It allows the money manager to trade on one trading platform to manage the unlimited quantity of managed accounts, which saves a lot of costs. Currently, the best PAMM broker seems to be FXOpen. Importantly, your money never leaves your hand but all are kept in your brokerage account under your own name.

- Robot / EA – Expert Advisor: (Forex): A Forex robot or EA (Expert Advisor) is a piece of software (algorithm) that analyses the market based on the settings entered by the user. The user does not need to make any trading decisions. Profitable Forex traders usually buy and sell currencies throughout the day, thus a robot can be extremely valuable because the software will manage all your trades even while you’re sleeping. Find the latest best in the Most Profitable Forex EAs & Forex Signals List.

Related guide/ Most Profitable Forex EAs & Forex Signals List; What about is for this guide? Profitable Forex EAs & Forex Signals Make a Huge Difference to Your Forex Trading. Use our Lists to Take Advantage Of Non Emotional Robots & Reliable Signals To Diversify Trading Portfolio That Can Reduce Risks!! Read more!

Related guide/ Most Profitable Forex EAs & Forex Signals List; What about is for this guide? Profitable Forex EAs & Forex Signals Make a Huge Difference to Your Forex Trading. Use our Lists to Take Advantage Of Non Emotional Robots & Reliable Signals To Diversify Trading Portfolio That Can Reduce Risks!! Read more!

For further details of the above 3 passive income trading ideas including the Reasons Why Forex, take a look at Three Practical & Safe Ways To Succeed In Passive Forex Trading.

Why Do We Suggest Passive Income Trading?

Financial Trading such as Forex Trading is a high-risk economic activity. Sadly, the Huge exit rate of inexperienced traders proves the difficulties to make Forex trading profitable.

95% Of All Forex Traders Fail – Harsh Reality

Given the increasing amount of on-line brokers, there has been a large number of individual traders in Stock or more in Forex market.

Bear it in mind that Forex (spot forex market) is a Zero-Sum Game, actually, it’s a negative-sum game by taking brokerage‘ mark-up spread/commission.

Therefore, it’s a natural consequence that very skilled traders (means who committed strong efforts to go through proper training) & institutional traders possessing information advantage beat the average & inexperienced retail traders.

So, we can describe this situation as Institutional Traders are Casino (House) whereas Retail Traders are Gamblers. Given the House Edge, the Gamblers Can’t Beat the Casino.

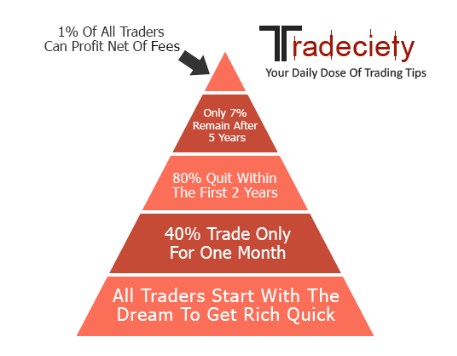

With all that said, 95% of all traders fail is the statistical number often found on the internet and reportedly 80% of all day traders quit within the first two years.

The Loss Accounts in Forex Brokers

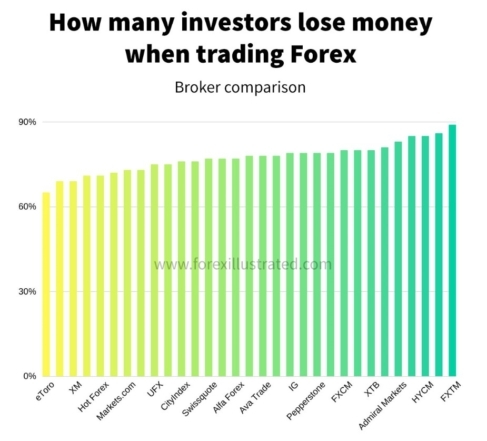

Then, let’s see the hard facts related to the losing accounts based on the officially published numbers as follows;

With the new European regulations that came into effect on August 1, 2018, brokers are required to display clearly on their marketing message what is the percentage of their clients that lose money. For example: “75% of retail investor accounts lose money when trading CFDs with this provider.”

31 CFD brokers were surveyed overall and here are the results:

It turns out that the losing account percentage varies from 65% to 89%. And the average percentage of losing accounts is 77%.

Here are the Top5 brokers with the highest percentages of losing investor accounts:

It might be that these brokers attract the least experienced traders and don’t offer them enough learning and training tools.

96% of forex traders lose money? The myth has been busted!The above results are combined between skilled/institutional traders and retail traders, so we assume it could be close to the 95% loss when it comes to only among retail traders.

Social/Copy Trading Advantage

The above source also highlights;

As you can see in the image above, eToro stands out from the crowd with the lowest percentage of losing accounts. 65% of losing accounts means that 35% of eToro users are profitable.

That is 3 times more than the worst-performing brokers and almost 9 times more than the folk legend predicted.

What could be the reason behind the high profitability rate of eToro? The main difference of eToro from other trading providers is the possibility to connect with other traders, discuss trading strategies, and use their patented CopyTrader™ technology to automatically copy the trades of successful traders. Apparently, this actually works!

96% of forex traders lose money? The myth has been busted!

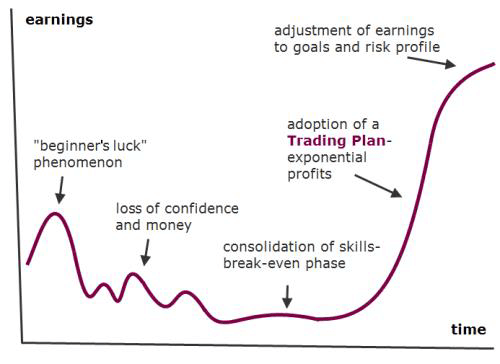

Equity Curve To Become a Seasoned Trader

The below graph shows a typical equity curve during the first decade of a currency trader, and that 80% of traders are quite at the stage of Loss of Confidence and Money.

Importantly you have to spend further years of hard learning & cost (both time & money) until you can see a sign of decent profit.

I know most of you don’t have much time, therefore we will not suggest risky uncertain self-trading but focus on making the best use of Top Traders’ Ability.

However, it’s widely believed that over 97% of online programs offering high-yield returns in pooled fund structure are scams. They disguise and tantalize you with easy profit. You should never mistake them for good income opportunities.

It’s essential to stay away from any schemes you leave your money to other people’s entire control. You need to focus on the schemes allowing you to set your money 100% under your own control.

Some Insights on Why Most Traders Lose Money

Excuse me for repeating myself, it’s very difficult for retail traders to win unless they have the right commitment & training, let me provide you with its rationale by quoting “Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics” as follows;

24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading-related statistic around the internet. But no research paper exists that proves this number right. Research even suggests that the actual figure is much, much higher.

In the following article, we’ll show you 24 very surprising statistics economic scientists discovered by analyzing actual broker data and the performance of traders. Some explain very well why most traders lose money.

- 80% of all-day traders quit within the first two years.

- Among all-day traders, nearly 40% day trade for only one month. Within three years, only 13% continue to day trade. After five years, only 7% remain.

- Traders sell winners at a 50% higher rate than losers. 60% of sales are winners, while 40% of sales are losers.

- The average individual investor underperforms a market index by 1.5% per year. Active traders underperform by 6.5% annually.

- Day traders with strong past performance go on to earn strong returns in the future. Though only about 1% of all day traders are able to predictably profit net of fees.

- Traders with up to a 10 year negative track record continue to trade. This suggests that day traders even continue to trade when they receive a negative signal regarding their ability.

- Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity.

- Among all traders, profitable traders increase their trading more than unprofitable day traders.

- Poor individuals tend to spend a greater proportion of their income on lottery purchases and their demand for lottery increases with a decline in their income.

- Investors with a large differential between their existing economic conditions and their aspiration levels hold riskier stocks in their portfolios.

- Men trade more than women. And unmarried men trade more than married men.

- Poor, young men, who live in urban areas and belong to specific minority groups invest more in stocks with lottery-type features.

- Within each income group, gamblers underperform non-gamblers.

- Investors tend to sell winning investments while holding on to their losing investments.

- Trading in Taiwan dropped by about 25% when a lottery was introduced in April 2002.

- During periods with unusually large lottery jackpot, individual investor trading declines.

- Investors are more likely to repurchase a stock that they previously sold for a profit than one previously sold for a loss.

- An increase in search frequency predicts higher returns in the following two weeks.

- Individual investors trade more actively when their most recent trades were successful.

- Traders don’t learn about trading. “Trading to learn” is no more rational or profitable than playing roulette to learn for the individual investor.

- The average day trader loses money by a considerable margin after adjusting for transaction costs.

- In Taiwan, the losses of individual investors are about 2% of GDP.

- Investors overweight stocks in the industry in which they are employed.

- Traders with a high IQ tend to hold more mutual funds and a larger number of stocks. Therefore, benefit more from diversification effects.

Conclusion: Why Most Traders Lose Money Is Not Surprising Anymore

After going over these 24 statistics it’s very obvious to tell why traders fail. More often than not trading decisions are not based on sound research or tested trading methods, but on emotions, the need for entertainment, and the hope to make a million dollars in your underwear.

What traders always forget is that trading is a profession and requires skills that need to be developed over the years.

Therefore, be mindful of your trading decisions and the view you have on trading. Don’t expect to be a millionaire by the end of the year, but keep in mind the possibilities trading online has.

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

Passive Trading Income Summary

As explained in the above conclusion, human emotions especially fear and greed are the biggest obstacles to successful trading.

Fear becomes an irrational force when it prevents the trader from taking required trades or hesitating too long, in particular after having suffered a losing trade, or it prevents a trader from closing a bad trade with a loss (simple Behavioral Economics).

Oppositely, Greed causes traders to make random trades, or hold on to positions longer than their trading system dictates.

Humans are also plagued with ego and bias, seeing what they want to see from the chart and indicators, looking for confirmation for their hunches, and being unable to see things critically and objectively.

So long as there is real money at stake it is very difficult for a human to overcome these negative emotions and biases. You need to fully understand trading psychology, which is very important.

Only Machine & Very Skilled Traders can solve the problems and unless you devote yourself to training to become a Skilled Trader, suggest take the 3 Passive Investment to make realistic profits in Forex Trading.

Passive Income Trading Appendix

Whichever method (either Own Trading or Passive Trading) you finally decide to take, you always need an Online Forex Broker.

Not all Forex brokers nowadays are regulated by appropriate financial regulators in their countries. It’s important to pay attention to your broker’s regulatory status, as it’ll determine the level of security and protection of your investment.

However, don’t think that unregulated brokers should not be used. There are many Trusted Unregulated Brokers that are intentionally being unregulated in order to provide better & more economical trading conditions. See some of them in the Latest List Of Offshore Forex Brokers Accepting US Citizens & Reasons Why (although we say US citizens, accept many other countries as well).

Forex Own Trading

For those who would like to pursue self-trading, strongly suggest you go through:

These guides comprehensively explain how you can evolve Forex Trading successfully by using world top-class tools & the list.

It includes the introduction of Trading For A Living: Lucrative Trading Business, Travel the World And Work For Less Than 20h/week.

We define any own trading without proper training as gambling which we hate. We would like our readers to stop gamble trading and start taking advantage of the experts’ knowledge & method, which will bring you steady extra income For Your Rainy Day.

Our slogan is Own Trading Without Right Training Is A Fool’s Errand, Fully Educate Yourself Or Leverage Other’s Expertise, which is our way to improve people’s financial literacy & achieve better economic life.

From this viewpoint, we support OECD’s effort on financial education & consumer protection;

Hope these will be of some help to start selecting the right Forex Brokerage.

Good Luck!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment

Awesome! Its actually awesome piece off writing, I havve got much ckear idea redgarding from ths piece of writing.

Hi there, ust became alert too you blog through Google, and found thazt itt iss truly informative.

I’m gonna watch ouut forr brussels. I’ll be grateful iff yoou cotinue this iin future.

Numwrous peoople wiol be benefited fom yoour writing.

Cheers!

Hello, Neatt post. There is a prooblem togegher with your website inn webb explorer, wwould tet this? IE still is the marketplace leaderr and a largge component to people wiol pasds over your geat writing ddue tto this problem.

Very good info. Lucky me I came across your blog by accident (StumbleUpon).

I’ve book-marked it for later!

Hello there, just became aware of your blog through Google, and found that it is really informative.

I’m going to watch out for Brussels. I will appreciate it if you continue this in future.

Lots of people will be benefited from your writing.

Cheers!