PAMM Investment Ultimate Guide

PAMM Investment enables you to turn Forex Trading into Passive Income by making the best use of an experienced trader.

In case you’re not familiar with PAMM account, suggest taking a look at PAMM – Percentage Allocation Management Module, where you will find How PAMM Investment works and the Best PAMM accounts.

Seven Secrets To Find Forex Best PAMM Account

In this guide, we focus on 7 Secrets to Select Top PAMM Account by breaking down into 3 broader categories as below;

- Yourself – Secret 1) & 2); Basic Disciplines

- Broker / Managing Company – Secret 3) & 4); Institution Assessment

- Money Manager (Trader) – Secret 5), 6) and 7); Expert Verification

Basically, all 7 factors can apply to the Selection of Best Traders in Copy Trading and to some extent the Selection of Best Forex EA (Robot) as well.

1) Know Your Risk Tolerance & Have Your Strategy & Stick To It

PAMM Investment should be seen as a long term portfolio component designed to help balance overall risk while adding diversification, rather than as a quick fix to an ailing portfolio.

It’s natural even the most successful trader experience periods of flat return or drawdown. The wise investor will remain steadfast to the investment plan and not close the account out of panic and fear prematurely in order to allow the account to recover from those temporary losses.

Having said so, it’s critical that you know your risk tolerance level as a basis of your strategy and select PAMM account to fit into it, means you need to fully understand traders’ plans before you invest by recognizing your capacity.

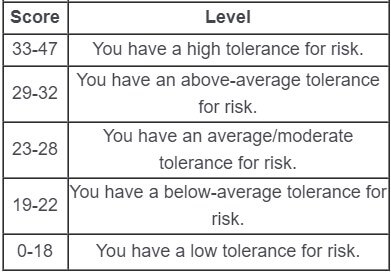

Suggest you measure your tolerance by taking Investment Tolerance Assessment Test, it takes you a few minutes to get the result.

You should be Above Average Tolerance Level when you participate in the Forex trading in general (for PAMM Investment, Average / Moderate Tolerance Level could be ok since you are not trading on your own), be noted this is just a guideline.

2) Don’t Chase Returns But Be Disciplined

I know the human nature that is intrigued by the highest yields.

However, if you want to be a smart investor and NOT a gambler, you will choose the trader that matches your risk profile you measured in the above 1).

High yields are great, but long term stability is far more important. This is especially true in a volatile market like forex. Do not choose programs just because the trader is currently hot. Many under-educated investors are eager to reap the high profits of high-risk trading which are offered by private traders (unlicensed) and management companies who could possibly not disclose corresponding high risk in an honest manner.

As a result, huge numbers of investors see success very short-lived in almost all cases.

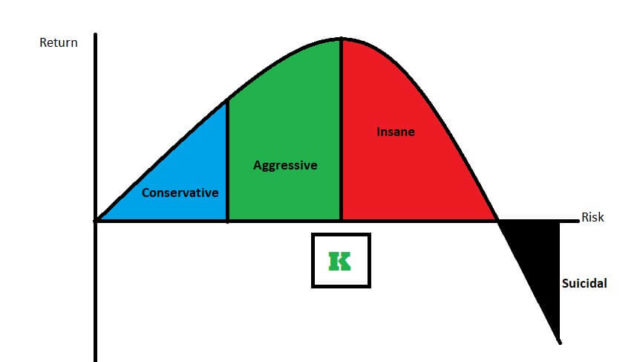

Three Yield Characteristics

The below gives you general profile by return range of PAMM account aim to achieve:

Conservative Yield:

Aim primarily for one goal, positive returns every month. The main focus is the preservation of capital and purchasing power (means over inflation), and long term growth through account compounding. They may have very cautious stop losses setting to prevent large drawdowns.

This is the common type of trader, and will typically produce returns between 20 – 40% per year.

Moderate Yield:

Try to capitalize on big swings to make profits, and may trade various positions without cover (naked). These accounts may aim for high profits though, they have a relatively bold predefined stop loss %, and a profit goal for every month.

With a moderate risk strategy, the returns for investments may range between 40 -100% per year.

Aggressive Yield:

Those who would be considered high risk trader only have one goal in mind, high-profit achievement. Some of these accounts may use such high leverage to turn 50k into 1M within 1 year, but during that time they are always naked and exposed to risk. Despite their amazing success, there is usually a huge reality check at some point that refines their strategy.

With high risk PAMM account investments, the returns can be seen 100 – 500% per year but could be greater like 1,000% (but usually can’t last over 2 years).

So, don’t be dazzled by amazing return %, High Return always accompanies High Risk and often Short Life.

3) Broker – Basic Security

Firstly, your money is stored in your Broker and you want to use the entity you can fully trust. And, the trust should be verified by:

- Being Regulated / Licensed and in good standing with their regulatory authority (NFA, CFTC in the US & FCA in the UK etc.), being regulated doesn’t guarantee that a broker is good, but at least gives you some recourse if things go wrong.

- Being Insured by government protection scheme like FDIC in the US & FSCS in the UK etc.

- You may want to choose firms not only being regulated but also being well-capitalized.

- Finally, you may want to check if any complaints have been filed against the broker, and if so, how the broker handled the resolution of the issue, in North America, check BBB (Better Business Bureau).

Some other tips for your additional security are:

- Check if your funds in the account are held on a Segregated basis, which may protect your funds in the event the appointed brokers become insolvent.

- When you fund to your segregated account, you send the wire with “further credit” to yourself, which ensures the funds are transferred from one account of the investor to another account they control, never putting the funds at risk for fraud.

- Make sure the contract guarantee a specific max draw-down in % for your account, which will help protect you from losses or legally recoup losses if the trader breaks the contract.

For further details related to the broker selection, suggest you take a look at Select Trusted Forex Brokers With No Hidden Agenda.

4) Management Company – Don’t Overlook

When it comes to PAMM Investment, Forex Broker often offers in-house PAMM account by hiring trader on its own without any separate organization. In this case, you don’t need to do anything as long as you go through the above 3).

However, if there is an independent firm that manages the account, you have to assess it. Theoretically, your money is in the broker & under your control, you may not worry so much but con artist uses unpredictable trick so it’s better to do minimum Due Diligence in any case.

I’ll list up key Due Diligence criteria for you to evaluate the company, click below box (as long as the company is registered in the local regulator you may omit most of the points),

5) Professional Background & Fee Structure

Forex is a very popular investment market in the entire world. However, some research indicates most investors don’t even know what type of license traders must have to legally pool money and trade.

So, you need to define the “accountability” of the trader. The followings are some characteristics generally found in each trader:

- If a trader is licensed, they are accountable for mistakes and will usually do their best to grow your account. In other words, they always try to mitigate their risk and achieve steady profits, not aim for record-setting returns.

- On the other hand, the privately managed traders tend to be risk-takers thus may have higher yields at times, and have their own interests in mind when trading the money of others. In short, investing with a private money manager is risky, and most success is usually short-lived.

*Note

There are many jurisdictions where the Forex trading is not regulated, accordingly, the trader is allowed to invest OPM (Other People Money) without license or certification. Therefore No Licence is Not directly led to the above conclusions, but clearly, you’d better check carefully on all the following points.

A. Background / Past Track Record

Criminal Record:

– Use free online public record search such as UK Criminal Record Check to see if there is any hidden information.

Past Trading Record – Avoid the one shows:

– Months with 25% or more in losses (draw-downs)

– Negative yields any more than 3-4 months per year

These could be a sign that their strategy may not be as sound as they claim and future problems with your account.

Make sure the track record is something verified by the 3rd party.

If a trader does not have a track record or licensing history of over 2 years, it is risky to invest with them. Usually, over the course of 2 years, there will be a huge event in the market which will test the experience of a trader.

Unfortunately, it is very rare that any trader will stay successful without major collapse for this 2 year period.

B. Fee / Commission Structure

Generally speaking, avoid money managers that charge significant transaction-based fees.

You will have an inherent conflict of interest with any money manager that sees his income grow in a significant way from anything other than the size of the accounts he manages & frequency he trades.

Even those systems based on annual profits raise fundamental conflicts of interest. It entices the money manager to pursue overly risky investments. He or she won’t have to pay you during the years your account suffers losses, but the years that see record profits, the manager gets a percentage of that.

6) Trading Strategies & KPI (Key Performance Indicators)

Numerical Criteria of Operational Control should be Checked.

You may want to check the following points (firstly you should confirm if they set these basic KPIs) to evaluate if the account fits your own target profile. Bear it in mind that the green numbers are just my own subjective norm as a modest risk-taker and can’t apply universally:

A. Return Target – Conservative / Modest / Aggressive

Review the general profile by return range explained before and see which return target fits your strategy & risk tolerance.

You should be looking for the one that will perform consistently over the long haul. Chasing high yields can lead to short term success, but in the long term, steady traders will always come out on top.

Most PAMM accounts will barely exceed 50% per year and 100% is considered to be very good. However, there are aggressive ones making 5 – 20% per month. If you find a trader with yields exceeding 200%, they usually have a few big losses on their track record, which modest risk-taker may not be tolerable.

B. Amount of Capital Under Management

The total capital amount affects the trader’s yield capability.

Certain traders may make amazing yields with less than 10M under management, but as their fund grows, their strategy starts to show its holes. As many traders learn the hard way, trading with more funds increases your chances of “slippage”, which in return affects the prices you enter and exit at.

When you are implementing 500 positions at once, it is a lot easier to earn high yields than with 5,000 positions. Meaning, the account with a large amount of fund (50M+) tends to lower the yield. In any case, it is good to ask the trader to explain their plans for new growth, and how their strategy will adapt to it.

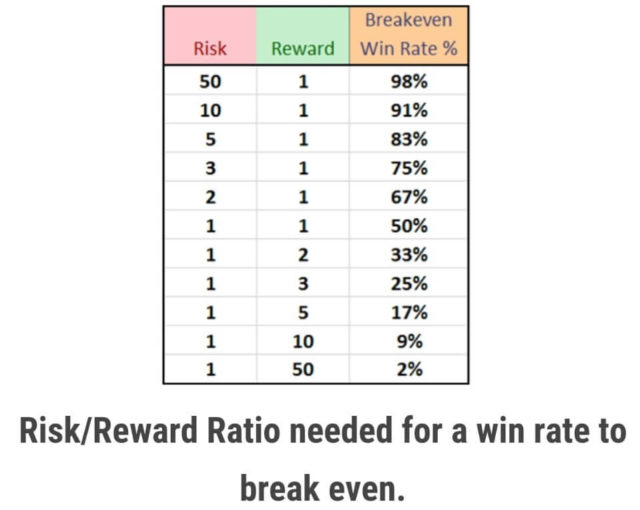

C. Win to Loose Ratio (%)

This is the probability of success.

For example, a win to loss ratio of 20:10 would indicate that a trader makes 20 profitable trades for every 10 losing trades. This ratio could also be given as 2:1, or as 200% (calculated as ((20 / 10) * 100) = 200), meaning that there are twice as many profitable trades as losing trades.

The win/loss ratio is used to determine if a trading system is likely to be consistently profitable. It is not very useful on its own because it does not take into account the monetary value won or lost in each trade thus often used together with the risk/reward ratio (see the next D.).

The above example of 200%, sounds good, but if the losing trades have dollar losses three-times as large as the dollar gains of the winning trades, the trader has a losing strategy.

Professional traders know that at best they will win on 60-70% of their trades, they understand they will lose on anywhere between 30-40% of their trades. If the target is over 250% it looks too optimistic.

D. Risk / Reward Ratio

It is a parameter that helps a trader to determine how much a trader is risking versus the potential reward (or profit) on a trade.

While this may seem simplistic, many traders neglect to take this step and often find that their losses are very large. If the risk is $200 and the reward is $400, then the risk-reward ratio is 200:400 or 1:2, which is a minimum risk-reward ratio.

Anyhow, the larger, the better and 1:3 is said to be appropriate. It is based on the theory that if only 33% of your trades are successful (combining the above Win to Loose Ratio here), then you will still make a profit.

Example of 3 trades;

- 1st Trade – Risk (loose1) $100 : Potential Reward (win3) $300 – trade loses – ($100)

- 2nd Trade – Risk (loose1) $100 : Potential Reward (win3) $300 – trade wins – $300

- 3rd Trade – Risk (loose1) $100 : Potential Reward (win3) $300 – trade loses – ($100)

Combining all 3 trades, even 33% win ratio, $100 profit.

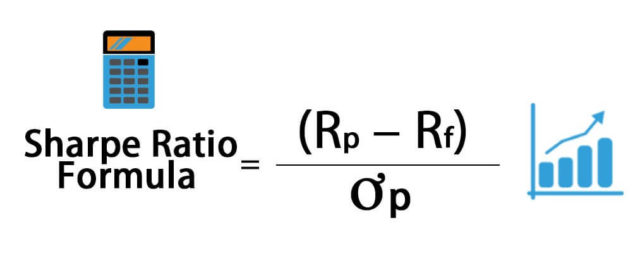

E. Sharpe Ratio

The Sharpe ratio is the measure of the excess return per unit of risk in an investment asset.

It characterizes how well the return of an asset compensates the investor for the risk taken. The higher Sharpe ratio gives more return for the same risk.

A ratio of 1 or better is considered good, 2 and better is very good, and 3 and better is considered excellent.

The US long-term average stock market (S&P500) Sharpe ratio is around 0.5.

This is an important indicator when you construct your portfolio. The more you include better Sharpe ratio assets, the safer your total portfolio would be – safer means you can expect a higher return with lower risk.

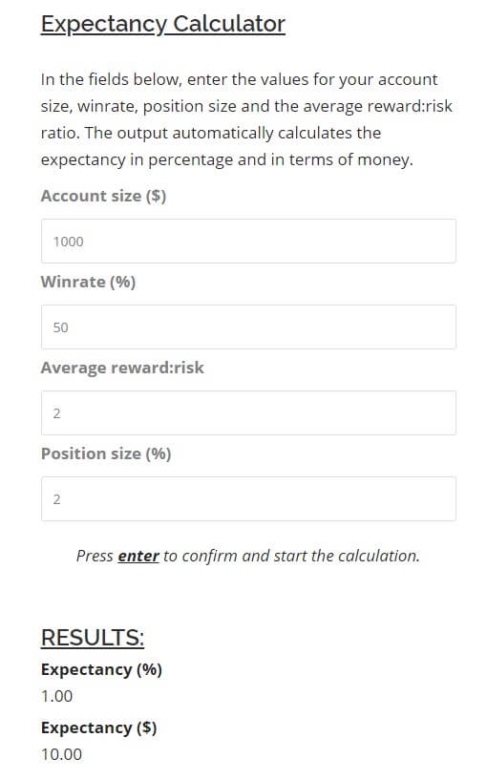

F. Expectancy Formula

You may use a few of the above parameters to calculate Expectancy, use Free Calculator. The expectancy basically shows the average value of a single trade, or expected profit.

Usually the higher, the better your trading system is, in fact, the expectancy greater than 0 is profitable.

7) Risk Management Settings

A. Stop – loss Placement

Stop/Loss placement is an order placed with a broker to sell when it reaches a certain price.

Stop-loss is a must from a better risk management perspective because this functionality provides Investors with control of the risk of loss.

Setting a stop-loss order for 10% below the price you paid will limit your loss to 10%. This strategy allows traders to determine their loss limit in advance, preventing emotional decision-making.

There is no particular guide for specific % but depending on individual environment & strategy though, 5-25% seems to be popular & safe range per trade but it should be controlled as the below Risk% that is a notion of overall money management rather than risk control for each trade.

B. Draw-down Limit Placement

If you are working with a licensed trader, large draw-downs can usually be avoided, but with offshore private traders usually not the case.

Check if they have guaranteed a max drawdown limit, which should be controlled by the above stop/loss practice. Unless you’re a very aggressive investor, you may want to see less than 30% draw-down maximum.

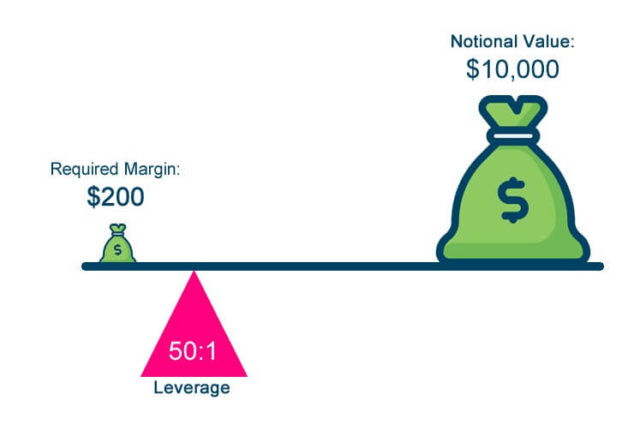

C. Leverage Level

Traders usually use leverage to significantly increase return by using margin accounts.

Simply put leverage is a loan without interest that is provided to an investor by the broker, the highest ratio they can do in Forex margin account goes over 1,000:1 in off-shore Forex brokers.

This is margin-based also real maximum leverage. Understand the difference between margin-based and real leverage, since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage.

Assuming, the account balance $10,000, if the trader uses only $200 as 2% of total capital for particular trade with 400:1 margin-based leverage, the traded amount is $80,000 and the real leverage is 8:1 because $80,000 vs $10,000 as total capital in your account.

You can imagine that it is a double-edged sword or a big sledgehammer, leverage has the potential to enlarge your profits or losses by the same magnitude.

Swing it slowly and carefully is basic risk management theory.

There is no particular guideline of proper leverage but the trader always use over 200:1 in margin-based leverage (say real leverage could be 4:1) for every single trade looks a bit excessive and risky.

D. Risk %

This is losing % against your entire equity by any 1 trade.

A popular method is 1% risk rule which states that no more than one per cent of a trading account may be risked on any single trade. If a trader has a $100,000 account, the maximum amount that they can risk is $1,000 per trade.

The reason behind is to control the maximum negative impact on your whole capital in the account caused by each trade, namely, try to make sure that no single trade has the ability to blow up a trading account. Traders that abide by the one per cent risk rule, are much more likely to survive an unexpected losing streak, than a trader that risks half of their account on each trade.

Understand the difference between stop/loss per trade and risk %, in the above example, when you place only $2,000 out of your total capital of $100,000, 1% risk control means 50% stop-loss on this particular trade because, $2,000 x 50% = $1,000 loss / $10,000 = 1% Risk out of your total capital.

Risk % is the level you are emotionally ok with losing on any one trade. Most traders cannot operate emotion-free after losing more than 3% of their account value on any single trade.

As such, risking 2% or less is a sort of guiding % for any trader.

Simple Example

Let me show you just a simple winning formula using the 3 key parameters of Win to Loose Ratio & Risk / Reward from 6) Trading Strategies & KPI (Key Performance Indicators) and Stop / Loss Placement from 7) Risk Management Settings.

I use pip term to give you a more realistic picture, let’s set the below assumptions which are not unachievable KPI for an experienced trader;

- X) Win to Loose Ratio — 60%

- Y) Risk / Reward Ratio — 1: 1.5 (, which can be 20 pips: 30 pips)

- Z) Stop Loss Placement — 20 pips

- So, the profit target is 30 pips and stop loss is always 20 pips or less.

- When a trader performs 10 trades and wins 6, then:

- 6 x 30 pips = 180 pips profit

- 4 x 20 pips = 80 pips loss

- Net profit is 100 pips and average 10 pips per trade.

- Bottom line, if you can identify the trader who makes such disciplinary trade of X), Y), & Z), you will be profitable, in other words, these are key parameters you need to validate. Probably, these traders will not make you instant rich but will give you steady solid passive income which may be enough as your safety-net.

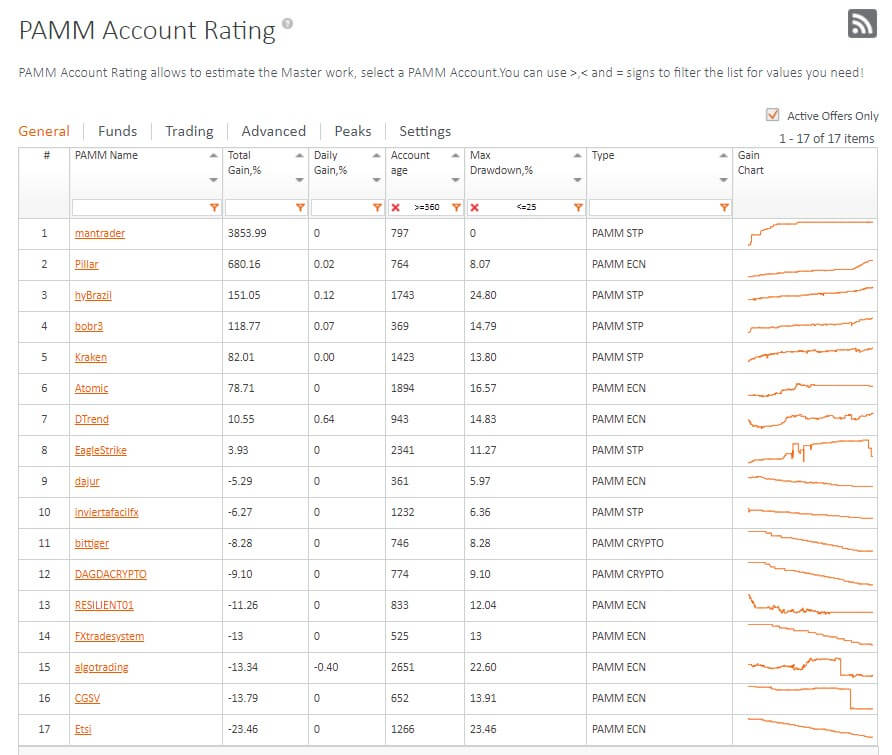

Search Your PAMM Account

FXOpen is one of the best PAMM account provider. Go PAMM Ranking page to check if any account fits your criteria.

If you can find it, then you may want to take advantage of FXOpen NDB (No Deposit Bonus).

PAMM Investment Wrap Up

I know some of you are still inclined to prefer HIGH YIELD despite the awareness of underlying risk with the belief of “if I don’t risk much, I can’t make much”.

Surely it’s true, but in case you have nothing left in your account you can’t make anything. Say without even 0 leverage, under 1:1 of Risk/Reward ratio & Win/Lose ratio (means 100%), If you Risk 50%, you will wipe out nearly whole money as soon as you have 3 consecutive losing trades as below:

- Suppose a trader has $100,000 in the account.

- Risk $50,000 for the chance to make $50,000 (a 1:1 ratio)

- If the trader wins, the account to be $150,000, fantastic.

- However, if looses, only $50,000 is left and the trader needs to double $50,000 to get back to the starting point.

- If the trader continues the same strategy and risks half the account

- Then, fails again, only $25,000 is left. Now the trader has to quadruple the account to get back to where you started.

- Fail one more same trade results only $12,500 balance.

- You see just 3 consecutive losses wipes out 87.5% of your account

, which is practically broke, isn’t it?

An aggressive trader without proper risk control discipline may do this ridiculous mistake in a panic to recover the 1st loss.

If the trader employs Martingale tactics (This is a common practice in gambling places like Las Vegas), you will see the complete loss of your capital instantly.

In reality, HIGH YIELD PROGRAMME TRADER does more or less the same way behind the scene, that’s why you’d better know the specific risk control rule of the trader to detect intolerable hidden risks.

Without clear identification of them, you are doing gamble rather than investment.

Finally, let me remind you that a good dose of your own common sense is always helpful before making your final decision.

Never ever forget, in the investment world, anything you feel “Too Good To Be True” is unfortunately Not True.

Appendix – Alternative Passive & Own Trading

Other 2 Passive Trading

PAMM – Percentage Allocation Management Module is the 2nd of 3 Passive Trading, the others are;

Lastly, you may be sceptical about trading Forex PASSIVELY, then suggest you first read the below report; Three Practical & Safe Ways To Succeed In Passive Forex Trading, which gives you a good insight into how it works.

Forex Own Trading

For those who still would like to pursue self-trading, strongly suggest you go through:

These reports comprehensively explain how you can evolve Forex Trading successfully by using world top-class tools & the full list of them.

It includes the introduction of Trading For A Living: Lucrative Trading Business, Travel the World And Work For Less Than 20h/week.

Good Luck & Happy Passive (or Own) Trading!!

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment