Trusted Forex Broker Introduction

Beware Some Forex Brokers Are Your Enemies, Be Wise To Choose The Trusted Forex Brokers That Have Common Interests With You!!

There are only 2 ways to make profits from Forex Trading, which are either you yourself become a skilled trader or you use skilled trader’s expertise.

Whichever the path you chose, the essential factor to make profits in Forex Trading is Selecting The Trusted Broker.

What do I mean by the NOT Trusted broker then? I’m not referring to scam or poor management online brokers that can’t be sustainable but talking about the legitimate brokers that have hidden agenda – Conflict Of Interests with Their Own Customers.  So, in this report, we will introduce several unpleasant trading situations you may have experienced and explain why those weird things happen & solutions.

So, in this report, we will introduce several unpleasant trading situations you may have experienced and explain why those weird things happen & solutions.

Forex Brokers – Disturbing Facts

I need to talk about some disturbing facts related to a specific type of Forex Brokers that have a hidden agenda. I believe the best Forex brokers for beginners (of course for any traders) are the brokers who are interested in Your Winning.

Namely, those who adopt the system that earns money when you win, in other words not competing with you or squeezing from you. Unfortunately, there are many brokers that make ugly manipulation because of the conflict of interests with you as a customer.

You as a vulnerable individual retail trader should recognize these hidden actions & their motives based on the profit structure. Then you will have the right knowledge to select the right brokers.

Note

I am quoting several examples of existing brokers below based mainly on their members’ testimonial or from various review sites. These are not verified by any 3rd parties, thus I show only their initial rather than the full name.

Typical Weird Situations

Error Message: Re-Quote / Wait / Trading Context Is Busy

These May Sound Familiar, But Not Good Signs.

If you often receive error messages like ‘re-quote’, ‘wait’, ‘trading context is busy’, ‘quote is accepted’, ‘request is in process’ etc. during your trading, you are trading against a classic questionable Forex broker.

These errors do not exist in the real market with real liquidity providers. The part of retail trading is still so small that lot size we trade is, in reality, nothing on Forex $5 trillion daily market turnover. Every liquidity provider tries to execute any transaction instantly and as fast as possible.

There are always a few traders on the other side who open an opposite position from you. So, if you do face the above-mentioned errors it is because the software of the trading platform looks for the worst price which can be delivered to you, nothing else.

Let’s see some other weird situations;

Mysterious freezing or disconnection when big market news comes in?

Example — “T” Fx

When news are coming I’m getting a lot of disconnects, the platform is freezing with “T” fx , this is a big problem because as you all know we need fast actions. I have an account with “T” for about 5 months and have had two problem with them;

- I had a buy pending order on eur usd the price went 10 pip after my pending order and did not hit it !!!! 5 minutes later the price flay 150 pips up I most say this most be my pips.

- One sale order been open , I never ever open it my EA never open it, how I know because my robot is been set up to take profit and stop loss and this sale order been open with out stop loss and take profit . I email them and answer my email with rejection they said that my EA opened the order. I been testing the robot on 5 different demo account and never had this problem with any one else but “T” Fx. So they try all they can to keep you away from making money.

Unbelievable surprise that your order wasn’t executed as you thought?

Example — “A”fx

Open an account with “A” FX 3 weeks ago, and use a signal provider (opens automatic in my account). I make a complaint about the opening of the orders that were closing with a difference of few minutes from my provider, and have an order that had closed negative in my account and I wanted a refund in the same amount of 442.00 euros, which to my surprise instead of them resolve the issue, was out of my account the amount of 4,725.00 euros, saying that orders were out of market. As seen here, if a customer complains about some order, so they take advantage of this to trick customers. They sent me email saying it was only arbitration, but to my signal provider they did not take the money , he has account in “A” Fx too.

Your broker doesn’t allow scalping? Or you have to place SL (Stop Loss) & TP (Take Profit) order 5 or even 10 pips away from market price?

If so, they have a dealing desk and they trade against you hard.

Example — “S”bank

“I used “S” for almost a year. Right, the stop loss price never hit and would loose money, plus three times it started up it’s own buy a commodity automatically at unearthly hours of 5 am!!!! and another time when there was no one home to place the ‘buy’!

When i complained they said someone had done it from our computer and they could do nothing about it! We lost about 3000 us like that! Very risky/dangerous.”

Your broker doesn’t allow Expert Advisors (EA)? Or your EA works properly on demo but on the real account does not?

Example — “TK”forex

“Initially all seems good, but then applying my scalping strategies (I choose this broker for scalping) I slowly started to be kicked out of my trades also if my stop-loss where quite away. I use a visual EA to handle orders TP and SL. Just today I lost money on two short positions and I was stopped out with the price never reaching my SL level (the spread was at the moment about 1.5).

Simply my order disappeared and been closed at a never reached price. Now I want to recover to reach a round number in my account then will close for sure the account. Stay away. I was already searching for a better broker. I have been systematically kicked out with abnormal slippage and my account is depleting.”

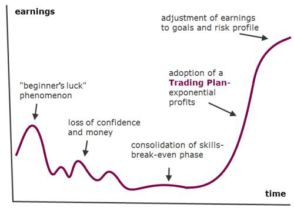

The Harsh Reality

Recognize the reality that such problematic broker is usually good as long as the trader is losing or trading with a small account. But what happens if you make some good profit?

At that point, you will ask yourself whether you chose the right broker because your broker may not pay you the profit or because you will suddenly experience some very strange behaviour when trading.

From this point on, your account will be ‘flagged’ and the broker will turn on all add-ons and applications which will trade against you, like a few typical stories that the real seasoned traders actually experienced.

Example — “P” Forex

I also began trading here starting with $2000, I made $6000 within a week. I was immediately switched to manual execution however I was still filled on a Canadian news release. I was 60 pips in profit and quite happy to close the trade there, but when I did, I was taken out with a false tic or fake price for a 9 pip loss. This happened four times so I closed the account.”

Example — “O”

I have traded fx with “O” for about two years now. At first, I had high hopes for them, everything seemed to be going fine, but like many others, I have become quite disillusioned. What do I think of them now? Here are just a few things I DON’T like;

- Very unstable with frequent disconnections and lockups (not due to my systems!) particularly when you want to take a profit or enter an obviously profitable trade opportunity.

- Stops are being hunted (prices spiking sometimes nearly 100 pips!) more and more frequently

- Prices will move to within a pip of my take profits and then reverse. This has happened all too often.

- Terrible charting, so I use mt 4 for charts

- When I report problems with the platform, they are routinely ignored, or treated as being insignificant

- Some nice little features such as drag and drop stop loss and take profit orders, but does this outweigh all the cons of this increasingly unstable platform? I think NOT!

Unfortunately, my experience with “O”, in spite of my initial good impression, has been very negative. I would caution any trader to avoid this broker like the plague!”

Example — “E”Forex

I would like to warn everyone using “E”- Forex. This is what happened last night. I bought oil futures and tried to close the deal when it showed me a profit of around $500 but couldn’t do it. It asked me to contact the dealers room and within seconds it converted into a loss of $70. This time I tried to close the deal and it did. When I spoke to the dealers room they said they can’t do anything except forwarding my complaint to my account manager. I am expecting some silly excuse tomorrow but if they don’t do anything I will take some action.”

If the Broker is Market Makers (MM) – They Are Your Enemy

Just read their agreement which you have to sign when you open a trading account with them. You will find that they are a counterparty – it’s exactly the same as Fixed Odds Bookmakers in betting industry (you will find the details of this particular point in Beat The Bookies By Knowing How Your Enemy Makes Money – Secret Of Odds).

With your acceptance of their agreement, you actually agree that they will trade against you. When you trade with them you are playing with numbers only and you do not trade on the market at all – the below explains how they operate.

MM: Market Maker – With Dealing Desk

Market Maker (MM) is a broker that will take multiple prices from different liquidity providers and decide which combination MOST SUITS THEM. NEXT, they will add a few pips to the spread and pass it along to YOU the retail Forex trader. In turn, they have just MADE a Market.

It has the following characteristics:

- When you place a trade LARGE or small – it is routed to the Dealing Desk if not immediately counter-positioned by a black

box against you and figured out later.

box against you and figured out later. What is later? Later is when the Dealing desk that has taken the opposing side to your trade gets around to see if you are a threat to their bottom line. If you are and have somehow edged through, 2 things may happen;

- they actually do offset the risk by putting your trade (through their name – onto the Inter-bank market to reduce risk and protect their net exposure).

- or

- they DO – CAN and will have your IP address/ (given, acct #) and can slow down your executions. If not completely block or freeze or RE-quote your account until you are in a losing trade. Stops are Not hunted in the sense many may think either – by unfairly widening spreads just to take you out. A retail broker is not going to get rich by taking out a couple mini lots from you. How it works is this. Brokers know where your stops are. You have in fact told them, so there is no secret. When a large number of stops accumulate in an obvious area, say 5 / 10 pips below the recent swing low. A market maker can go onto the real Forex market and place a large enough order to move the price back down in a less volatile time. Essentially wiping out a decent amount of stops before exiting, next the price continues on its journey backing and filling all the while.

- Scalping is useless, the spreads are too high, and the execution is lousy at best.

- It’s said that there are less than 1% of retail traders actually making really decent money (enough to live off comfortably) trading with a market maker.

Bottom-line

If you win, they lose and that is why they will not allow you to make any serious profit. The bookmakers in the betting industry are more honest in this sense because they openly restrict sharp punters account to protect their own profits.

In the worst-case scenario, such brokers can split clients into groups. And they put less successful ones on auto-execution and trade against them because on average they will lose.

On the other hand, the clients that show signs of successful trading will be put on “slow-down” mode and can be provided with frequent re-quotes, slippage and/or slower execution especially during fast-moving markets while a broker tries to offset own risks.

Example — “G”

I witnessed my client’s trade being closed by “G” intentionally. He called the dealing desk so that they can help me hedge the trade so that he can add funds on his account to sustain the trades (which they did ) but after it was hedged the same guys closed immediately.

I witnessed my client’s trade being closed by “G” intentionally. He called the dealing desk so that they can help me hedge the trade so that he can add funds on his account to sustain the trades (which they did ) but after it was hedged the same guys closed immediately.

We called the dealing desk but unfortunately, these guys were rude claiming that we had issued a market order immediately. But how would the same client issue an order to close the positions when his intention was to hedge? I spoke to “Mark” – head of the dealing desk.

He was so protective of his team, in a rude way he slammed the phone in my ears. These guys never called my client up to now -they claimed that my issue would be investigated with 2 days… The worst with this broker he does not give clear explanations about his system. how it works.

When you chart with his customer service it is like they just from college.. they give answers like “try that”. Friends I thought if a client makes money the broker should be happy!!! with “G” its the opposite. To make things worse they have a complex system.

If to compare it with other systems-its complex, really complex.. no time is taken to take you through the system. I think there must be guys behind who enter opposite trades whenever you are trading!!! To me “G” ain’t PROFESSIONAL- I would not recommend “G” to any of my clients!!!! Do not use “G” as your BROKER!!!”

Many MM are Regulated

Many brokers who screwed successful traders are regulated by NFA in the USA or FCA in the UK or any other regulatory bodies in each jurisdiction. Don’t get me wrong, I’m not saying regulation is useless, in fact, it’s quite important.

Market Maker itself is nothing illegal and actually plays a big role to expand & activate the whole market by providing liquidity at the same time thus there are basically no rules prohibiting MM from being regulated.

However, the point here is that it will still be your counterparty and it will still trade against you. Therefore they may screw you by finding loopholes of regulation in various manners.

Face The Hard Facts At The Market

Why is there a limited number of Non-MM brokers in the market? The answer is simple: Becoming Market Maker is easier and over 95% of all retail traders resulted in losing money.

So if you decide to open a brokerage company, why would you choose Non-MM that is the hard way of looking for liquidity providers, one where you even have to deposit $10 million on their account just so they are willing to give you their feed?

On the other hand, when you are one of those bucket shop brokers you just need to make a nice web page and buy a license from Meta Quotes… and you are in business.

Whichever math you do? the pay-outs to that 5% of winning retail traders can easily be covered with 20 or 30% of the losers… and the rest of the deposits are pure profit for these bucket shop brokers.

We hope you now become aware that the easy choice of broker may put you in a risky place to protect your money.

Market Maker (MM) 3 Hidden Agenda

With the all above explanations, you now realize 3 Hidden Agendas of Market Maker Broker, in summary;

- 1) MM has a conflict of interest with you as a customer

- 2) MM never openly speaks this fact to you unlike bookmakers in the betting industry

- 3) MM controls profit & loss of your account by manipulating trading & operations in various manner behind your back, unlike the bookmakers that explicitly restrict smart punter’s account.

So, MM does not seem to be honest & transparent and you will have very few chances to make big & constant profits without knowing the exact reasons why.

Given the obvious facts, it’s wise to avoid MM (Market Makers) when you choose a Forex broker. Usually, Forex Broker doesn’t openly say “I’m a market maker”, you need to know how to distinguish to select the best broker for you, which is a starting point to develop passive income stream in Forex trading.

Now, it’s time to discuss the type of transparent Forex Broker you should choose. Let me reiterate that no matter how you do Forex Trading (trade by yourself or ask someone to trade for you as a passive investment), you need Forex Broker and Forex Broker keeps your money, therefore selecting the Trusted Forex Broker is a paramount important process in Forex trading.

4 Essential Criteria To Choose Trusted Forex Broker

Let’s talk about the 4 criteria for top Forex Brokers;

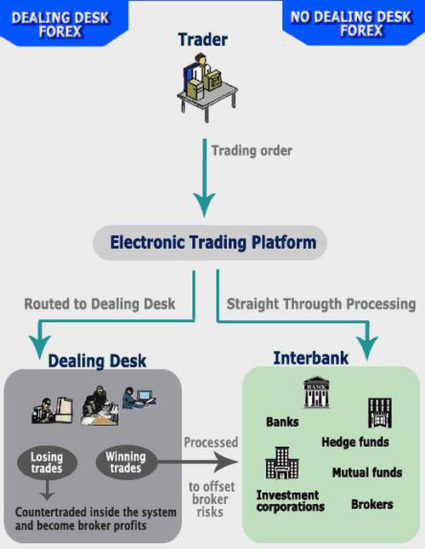

1) Not DD (MM) But NDD (ECN or STP with DMA)

Now, let’s analyse the brokers based on with or without Dealing Desk. Simply put, the NDD broker that has No Dealing Desk is Transparent where your order is directly accessed to the huge global Forex market. The below image from 100forexbrokers would help you understand how both each works visually;

Brief Explanation for Each Type;

DD brokers (Dealing Desk)

DD (Dealing Desk): Forex brokers that operate (route orders) through the Dealing Desk and quote fixed spreads.

This is the way MM (Market Maker) operates.

Market Maker

A quick run over, Forex Broker with Dealing Desk is a market maker – they literally “make the market” for traders: when traders want to sell, they buy from them, when traders want to buy, they sell to them, e.g. they will always take the opposite side of the trade and in this way “create the market”. A trader doesn’t see the real market quotes, which allows Dealing Desk brokers (MM) manipulate with their quotes where they need to fill clients orders.

MM broker makes money via spreads (bid / ask difference) and by trading against its clients’ open positions in the opposite direction means when a client loses a trade they make money.

NDD brokers (Non-Dealing Desk)

NDD Forex brokers provide access to the inter-bank market without passing orders trough the dealing desk. With true No Dealing Desk brokers, there are no re-quotes on orders and no additional pausing during order confirmation.

This, in particular, allows trading during news times with no restrictions on trading. An NDD broker can either charge commission for trading or choose to increase the spread and make Forex trading commission-free.

There are 2 types as follows:

- STP (Straight Through Processing) w. / w.out DMA (Direct Market Access)

- ECN (Electronic Communications Network)

STP (Straight Through Processing)

STP Forex brokers send orders directly from clients to the liquidity providers – banks or other brokers. Sometimes STP brokers have just one liquidity provider, other times several.

The more there are liquidity providers and therefore liquidity in the system, the better the fills for the clients. The fact that traders have access to real-time market quotes and can execute trades immediately without dealer intervention is what makes the platform STP.

Since STP brokers don’t trade against their clients, they add their own small mark-ups to the spread quote. This is done by adding a pip (or half a pip, or any other amount) to the best bid and subtracting a pip at the best ask of its liquidity provider.

DMA (Direct Market Access)

Direct Market Access (DMA) is a technology in No Dealing Desk broker with a Straight Through Processing model. The key difference between a regular STP broker and a DMA STP broker is that with DMA your trade never hits your broker’s book. It is placed directly with the Liquidity Provider.

STP broker with DMA never has Dealing Desk. However, many STP broker without DMA uses HYBRID STP model combining DD & NDD.

Here is the real complexity:  sometimes this broker routes your orders to the market (acts as an STP broker) but sometimes it doesn’t (acts as a Market Maker). For instance, successful traders or successful trading algorithms will be automatically routed to the market while small or losing clients will not.

sometimes this broker routes your orders to the market (acts as an STP broker) but sometimes it doesn’t (acts as a Market Maker). For instance, successful traders or successful trading algorithms will be automatically routed to the market while small or losing clients will not.

This way the broker profits twice: once by clients’ losses and another by not losing money to successful traders (of course this never works 100% but it does most of the time).

Consequently, the STP broker’s profits come from two sources: unsuccessful clients’ losses and commission arbitrage on routed orders when you trade at 2 pips with this broker, for example, it routes your orders to another broker or the inter-banking market thus making 1 pip without assuming any risk.

Example – “A” This “A” Standard and Micro accounts trade against you! They say that they are NDD but have been caught using the famous Virtual Trader Plugin from Boston Technologies. This plugin causes massive re-quotes, delays, slippage, spikes, etc.. If you start to win they turn up the heat on the plugin settings! Their only good account is the Pro account where you must deposit 20 000 dollars and trade 3 lots minimum. The other positive things are fast deposits, withdrawals (if you have any money left), fast transfers. But these don’t matter if the odds are against you!”

So, unlike such Hybrid STP,

True DMA / STP broker:

- Has a greater number of liquidity providers

- Never offers fixed spreads, only variable, because bid/ask prices constantly change as they come from liquidity providers

- Order execution is always Market execution

- There is no re-quotes

- Can also offer Depth of the Market book (similar to ECN I will explain next), where traders are able to see all bid/ask quotes from different liquidity providers

- Trading model welcomes traders of all types and styles: scalpers, news traders, swing traders, position traders or other regular traders.

ECN (Electronic Communications Network)

ECN Forex brokers operate same as STP but additionally allow clients’ orders to interact with  other clients’ orders. ECN Forex broker provides a marketplace where all its participants (banks, market makers and individual traders) trade against each other by sending competing bids and offers into the system.

other clients’ orders. ECN Forex broker provides a marketplace where all its participants (banks, market makers and individual traders) trade against each other by sending competing bids and offers into the system.

Participants interact inside the system and get the best offers for their trades available at that time. All trading orders are matched between counterparties in real-time.

Namely, the system allows you to enter a bid inside or outside the spread allowing for tighter spreads and more liquidity. In a way, you become the market maker when dealing with an ECN Forex Broker because they are routing your order to the best possible match elsewhere in the world.

Sometimes Hybrid STP brokers are discussed as if they were ECN brokers though don’t be tricked, to be a true ECN, it should have the following features:

- Only Market execution

- Only variable spreads

- Only 5 digit pricing

- Optional feature: DOM access (Depth Of the Market book access), means not only the bid and ask prices but also the amounts on either side of the price, this is the most notable ECN feature.

ECN brokers charge commission for trading Forex. The commission is the revenue/profit an ECN broker receives. ECN brokers basically don’t mark-up to the spread like STP but just quote natural/real market spread that can be 0. In fact, ECN brokers always offer DMA, but not all STP brokers offer DMA as explained before.

Key Reason Why Traders Should Chose NDD Broker

- Transparency – means that a trader enters a true market instead of the market being artificially created for him

- Better & Faster fills – shows the result of the direct and competitive market bids and offers

- Anonymity – means that there is no Dealing Desk watching who has come to the market and is asking for an order to be filled, instead client orders are executed automatically, immediately through the market network and totally anonymously.

MM / STP (DMA) / ECN Summary

Conclusion first, ECN brokers are the purest breed among all Forex dealers. Market Makers make money on spreads and by hedging against their clients. However, if a client becomes “too” profitable, it can directly “upset” the broker.

While this may be tolerated and professionally managed by a larger reputable market maker, with a smaller dealer such client will be soon asked to leave. STP brokers make money on spreads, but as said in the above most STP brokers run the Hybrid model combining Non-DD & DD (namely STP without DMA), means they also act as Market Maker who profit from client’s loss.

We still see some conflict of interest in STP brokers. ECN broker’s profit mainly comes from commission. ECN brokers are interested in their clients to be Winning, otherwise, there will be no commission to earn. Simply, choosing ECN / DMA broker is the most desirable.

2) Regulated & Licensed / Insured / Segregated

Your Account Safety is surely a key element, and you need to evaluate this fundamental with the fact if the broker is regulated/insured.

Regulated & Licensed

Being Regulated is still important.

In order to know why a broker should be regulated, we should know what regulation means:

- A broker must be licensed in the country where its service is offered, or it’s not legal. (Remember, there are a few countries where Forex broker is not regulated such as Finland, thus this principle does not necessarily apply to those countries)

- A broker must have strict quality control standards, or it will not be qualified by the national regulatory agencies

- A broker should receive periodical audits, reviews, and evaluations by reliable 3rd party professional

- A broker must maintain a sufficient amount of funds to prove it maintain the ability to bear the risk

- A broker is obliged to honor each position opened by a client, or its license will be revoked.

With all these, it’s a natural consequence to choose the regulated broker for your own protection. Pay attention to “sufficient amount of funds” – Presumably, the “regulated” broker would be forced to keep client deposits in an account segregated from company funds (see below for the detail explanation) so in the event of a bankruptcy, you may have better chance to recover something.

Usually, a broker has a disclosure statement in the “About Us” section of the site, and at the bottom of every page stating its membership of the regulators.

Segregated Account

Segregated accounts are dedicated client accounts that allow keeping client funds separated (segregated) from the company funds. The main purpose is to shield client investments from possible company risks by keeping such investments “unavailable” for the company to be used in the course of their business when facilitating their own risks, expenses, and obligations.

Should the company account become overdrawn, the company or its bank cannot use client funds. While trading in the Forex market, Forex brokers with no account segregation are able to engage client funds as margin against their own positions which are being opened to hedge against client trades; at the same time, brokers who work based on a segregated account scheme must use own funds to do the same.

Should a non-segregated account broker face difficulties getting out of his hedged positions, clients’ funds will constantly remain under the risk. This is never the case when client funds are segregated. Brokers can either opt for or be obliged (by their regulatory bodies) to open segregated accounts for their clients.

Currently, US law doesn’t allow holding Forex funds in segregated accounts. Oversees brokers, however, are able to offer this option. Segregated accounts can either be opened in the name of each individual client or can be Joint for all clients.

Usually, in the retail Forex industry, it’s going to be the second case (one bank account for all clients, opened in the company name) unless negotiated individually for large investors. In case, you are not convinced of the importance of the segregated account.

Insured

The possible benefit you may be able to get from the regulated broker is automatic insurance on your deposit (depending on jurisdiction FX brokers operates) like FDIC for bank deposit & SPIC for securities in the US. In the UK, each investor in the brokers regulated by the FCA – Financial Conduct Authority is eligible for compensation in the event of default of the broker. The coverage is provided by the FSCS

for securities in the US. In the UK, each investor in the brokers regulated by the FCA – Financial Conduct Authority is eligible for compensation in the event of default of the broker. The coverage is provided by the FSCS (Financial Services Compensation Scheme) which is £50,000 per person per firm as the maximum level of compensation for claims against firms declared in default. So far, we have touched the fundamental yet key elements to evaluate brokers as:

(Financial Services Compensation Scheme) which is £50,000 per person per firm as the maximum level of compensation for claims against firms declared in default. So far, we have touched the fundamental yet key elements to evaluate brokers as:

- If the brokers support your winning (no conflicts of interests)

- If the brokers are safe (for contingency)

Now, you need to check What You Want From Trading

3) Determine Your Needs Then Prioritize

Once you start trading, various trading conditions will practically make key roles. Therefore, before signing up, you should ask yourself, what trade you want to do, and create your own list of features you want from the broker.

The followings are a few key elements you should at least consider:

- Initial Required Deposit Amount & Minimum Trading Size

- Funding / Withdrawal method (wire transfer, credit card, Paypal, etc.)

- Spread & Commission

- EA Application & restriction

- Leverage & Margin requirements

- Trading Platform offered, etc.

These are the areas you need to prioritize & decide based on your trading & risk management strategies – sort those questions by the level of importance to you.

The choice of Forex Broker may depend on your trusted expert’s choice, therefore it’s important to check which Forex broker they use before finalizing the Passive Forex Trading specific scheme. BTW, why passive rather than own trading, as said at the beginning, visit Passive Trading;  , where you find its reason very briefly but clearly.

, where you find its reason very briefly but clearly.

4) You Need to Trade At Rest

Then, finally, you value the following simple factors:

A. Reliable Solid Reputation:

You may want to visit various review sites to check how people evaluate your prospective brokers. However, bear in mind that as a general theory, negative comments are usually more than positive comments because disgruntled customers, malcontents, and trouble-makers love to go on the internet and throw the slander around.

If you see too many negative comments without details of the issue it is often fishy, because it could be the competition of the broker. You should take all of that with a grain of salt.

On the contrary, if you see too many positive comments, that is also fishy. Because people usually don’t write anything if they are satisfied. If you find a lot of negative comments with details of what was wrong and the issue is often the same then it’s quite likely that there is something wrong with that broker and you will find the reasons in the comments.

No matter how many euphoric comments come afterwards from the broker’s staffs to delude the readers, you’d better avoid such brokers as a general guideline.

B. Reliable Customer Service:

This is where you turn to when there’s a dispute or problem, so the friendlier, more patient, and understanding they are, the better. Live Chat will be found quite convenient once you start putting in real money & face any problems.

In order to make sure that you are safe, it is always a good idea to make a call, even before you have any real intention of opening an account, to see the quality and endurance of the customer support staff. 24-hour support can also be very important. Remember that the Forex market is active 24-hours a day (not 7 days a week but 5 days).

So your working hours may not coincide with that of the support staff unless it is available throughout the day. Even you expect passive income from Forex trading where the broker is chosen by your selected trader, it’s recommendable that you check the above points on your own since there must be very few traders who would make negative comments on the Forex Broker they currently use when you ask.

Trusted Broker – Conclusions

The 4 Essential Criteria to evaluate brokers are:

- Transparency – ECN (No Conflict of Interests)

- Safety – Regulated / Insured / Segregated

- Suitability – Best Fit on Your Trading Environments / Condition

- Reliability – Solid Reputation / Excellent Customer service

1. & 2. are related to your Hard Money (profit & principal) and 3. & 4. are related to the level of How Comfortably you can make daily tradings.

On top of the above criteria, you should not forget about Cost. There are a few agencies that have a partnership with Forex brokers, they will provide you with various rebates without any change of your trading, simply kick back a certain % of their referral commission they earn from your sign-up via their link.

If you are interested, then visit;

FX Rebate Grus Cashback Forex

Cashback Forex Both agencies have a partnership with over 30 Forex brokers, but remember when you select the broker always check the above 1) – 4) points.

Both agencies have a partnership with over 30 Forex brokers, but remember when you select the broker always check the above 1) – 4) points.

Trusted Brokers Appendix

Not all Forex brokers nowadays are regulated by appropriate financial regulators in their countries. It’s important to pay attention to your broker’s regulatory status, as it’ll determine the level of security and protection of your investment.

However, don’t think that unregulated brokers should not be used. There are many Trusted Unregulated Brokers that intentionally being unregulated in order to provide better & more economical trading conditions, see some of them in Latest List Of Offshore Forex Brokers Accepting US Citizens & Reasons Why;

Joshua Walker (bio)

Editor – Global Extra Money (GEM)

Comment